Waters to Buy Andrew Alliance, Expand Technology Portfolio (Revised) – Nasdaq

Waters Corporation WAT announced that it has agreed to acquire Andrew Alliance for an undisclosed amount.

Andrew Alliance is the Swiss pioneer in robotics for the Life Sciences sector.

Andrew Alliance’s cloud-native software platform and modern interface improve the use of automation technology, making work easier for scientists. The company has approximately 40 employees in Switzerland, France and the United States.

The acquisition will help analytical laboratory instrument and software developer Waters to expand share in the growing pharmaceutical market. The software and new technologies acquired from the deal will help Water provide better and enhanced offerings to customers, thereby expanding customer reach.

In addition, the deal will expand Water’s reach in the mass spectrometry market. Per data from Markets and Markets, the mass spectrometry market is expected to reach $6.3 billion by 2024, growing at a CAGR of 6.7% between 2019 and 2024.

Waters is already one of the leading players in the mass spectrometry market and has been garnering significantly from the sale of advanced mass spectrometry instruments. Waters’ global pharmaceuticals business, its largest single market and a major revenue driver, is gaining traction over the last few quarters and fueling growth of the Waters Division.

Chris O’Connell, Chairman and Chief Executive Officer of Waters Corporation said, “The acquisition of Andrew Alliance broadens our technology portfolio to include advanced robotics and software that will positively impact our customers’ workflows across pharmaceuticals, life sciences and materials science markets”.

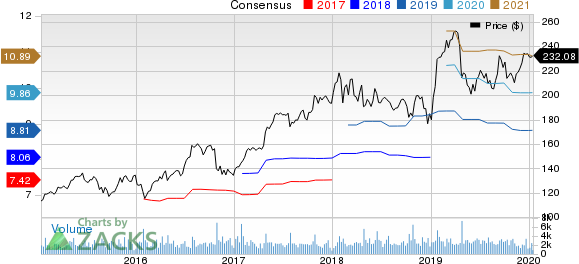

Waters Corporation Price and Consensus

Waters Corporation price-consensus-chart | Waters Corporation Quote

Price Performance

Waters has returned 17.9% compared with the industry 24.5% rally in the past 12 months.

Zacks Rank & Other Key Picks

Currently, Waters carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include Itron, Inc. ITRI, Bruker Corporation BRKR and PerkinElmer PKI, all carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Itron, Bruker Corporation and PerkinElmer, Inc. is currently projected at 25%, 12.5% and 12.5%, respectively.

(We are reissuing this article to correct a mistake. The original article, issued on January 14, 2020, should no longer be relied upon.)

Bruker Corporation (BRKR): Free Stock Analysis Report

PerkinElmer, Inc. (PKI): Free Stock Analysis Report

Waters Corporation (WAT): Free Stock Analysis Report

Itron, Inc. (ITRI): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.