Research: How Technology Could Promote Growth in 6 African Countries – Harvard Business Review

Africa is closely watched as the next big growth market – a description that has persisted for a while. There are many reasons for optimism: the African continent is home to some of the youngest populations in the world, it promises to be a major consumption market over the next three decades, and it is increasingly mobile phone-enabled. An emerging digital ecosystem is particularly crucial as multiplier of that growth, because access to smart phones and other devices enhances consumer information, networking, job-creating resources, and even financial inclusion.

Despite these reasons for optimism, the promise remains unfulfilled. Growth in Africa has stalled; both the IMF and the World Bank have cut their 2019 economic growth projections for sub-Saharan Africa (SSA) to 3.5% and 2.8%, respectively, with growth in 2018 at 2.3%. Poverty has increased — 437 million of the world’s extreme poor are in SSA — and 10 of the 19 most unequal countries in the world are in SSA. The World Bank projects that if poverty reduction measures and growth remain sluggish, Africa could be home to 90% of the world’s poor by 2030.

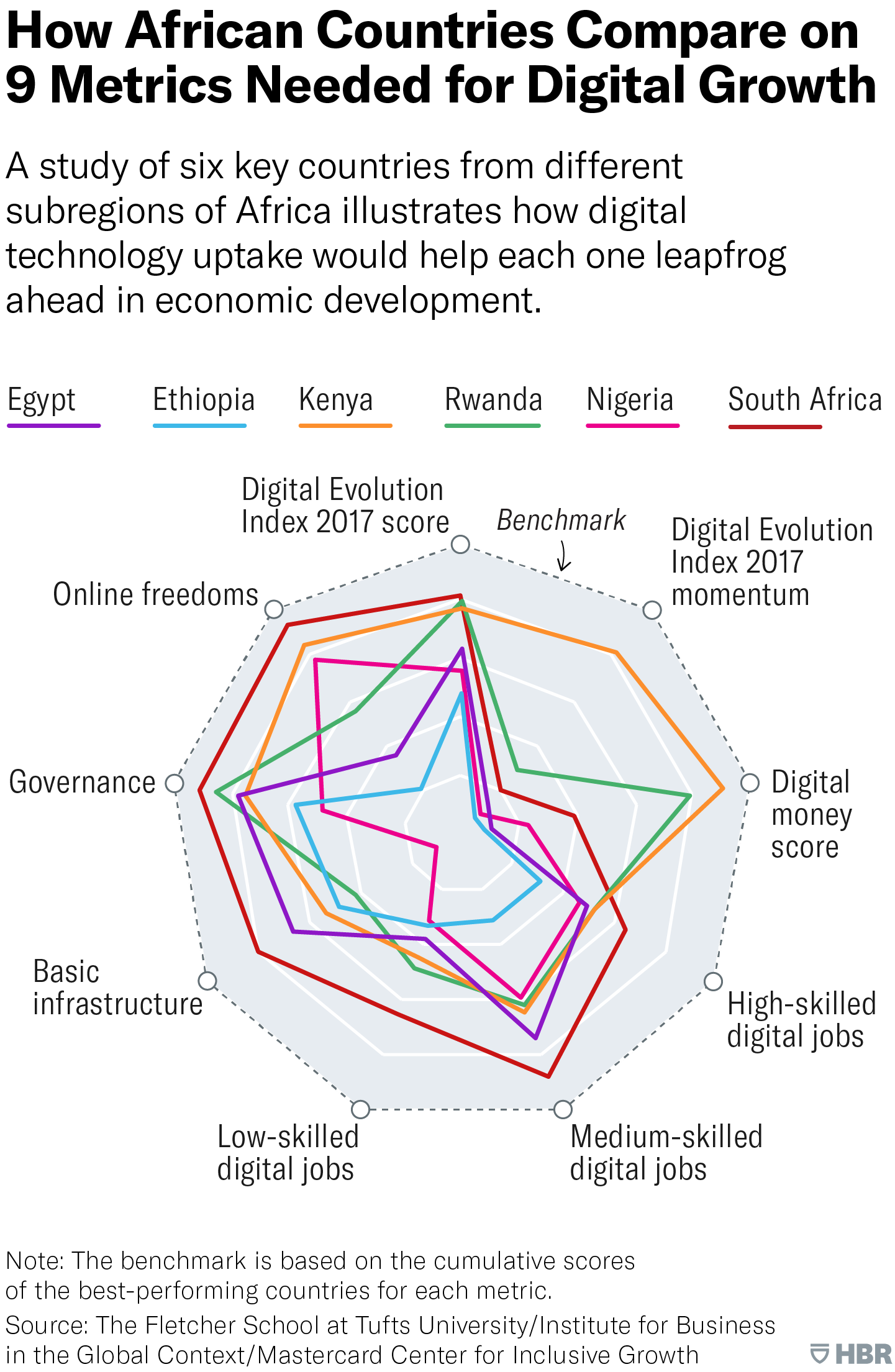

Despite these sobering statistics, we wondered whether the true acceleration potential for the region lies in the rapid spread of mobile digital technology, which would help the region “leapfrog” ahead in its economic development. At the Tufts Fletcher School, in a research project funded by the Mastercard Impact Fund administered by the Mastercard Center for Inclusive Growth, we examined this proposition. We studied six key countries drawn from different sub-regions of the continent representing distinct archetypes of size (of economy and population), economic growth, median age, quality of governance, and digital momentum : Egypt, Ethiopia, Kenya, Nigeria, Rwanda, and South Africa. We examined three primary categories of levers that could translate digital technology uptake into development and inclusive growth: jobs enabled by digital platforms; institutional drivers necessary for digital success; and the foundational digital potential of the country.

These levers were integrated into a framework we call the African Leapfrog Index (ALI), introduced here. ALI evaluates each country against a continent-wide “best-performance” benchmark by applying a process we have introduced in earlier HBR articles about global digital strategy. We hope it offers a handy tool for decision-makers in business and policy to identify country and regional strengths and prioritize the gaps to be closed.

Our framework integrates the following factors:

Ease of Creating Digital jobs

- Potential for High Skilled Digital Jobs: To what extent is the country ready for high skilled digital jobs, such as online freelance work?

- Potential for Medium Skilled Digital Jobs: To what extent is the country ready for medium skilled digital jobs, such as ride sharing services?

- Potential for Low Skilled Digital Jobs: To what extent is the country ready for low skilled traditional jobs created by the digital sector, such as e-commerce, which creates work in delivery services, warehousing and logistics?

Governance and Infrastructure Resilience

- Online Freedoms: Does the government allow for free speech and exchange online?

- Governance: Does the government have effective digital services and regulations in place?

- Basic Infrastructure: Does the country have reliable basic infrastructure, such as internet connectivity and mobile networks, as well as electricity supply?

Foundational Digital Potential

- Overall State of Digital Evolution: What is the level of the country’s digital development as measured by our Digital Evolution Index?

- Digital Momentum: How fast has the state of digital development changed during the past decade?

- Use of Mobile Money: To what extent has the country shifted from reliance on cash to digital money, particularly mobile money?

The six African countries we studied display different profiles in terms of strengths and gaps. Their relative standings along each of the essential factors are visualized in the graphic below. The outer boundary represents the benchmark and each country’s footprint is shown within the figure. The closer the footprint is to the outer boundary, the higher the leapfrog potential in the country.

There are several patterns of note. The six African countries can be organized into four segments:

- Paving the way: Kenya and South Africa

- Punching above its weight: Rwanda

- Untapped opportunities for growth: Egypt and Nigeria

- Potential for greatest digital gains: Ethiopia

Let’s look at where our analysis shows the greatest opportunities and gaps are for each of these countries.

South Africa

South Africa is a regional leader in the Ease of Creating Digital Jobs, buoyed by strong consumer demand for digital businesses and an institutional environment that offers supportive regulations, comparing favorably against key emerging market nations in Latin American and Asian/Southeast Asian regions. South Africa is also a regional leader in the deployment of several emerging technologies, such as biometric data and payment cards to deliver social security, drones in mining, which helps keep it at the innovative edge. South Africa also has several facilitating factors that reinforce its strengths: on a continent that struggles with power outages, it has the lowest frequency of monthly outages among the countries studied; it has high digital transparency measures, including a relatively strong Freedom on the Net score; and it was ranked 19th globally as a financial hub by the World Economic Forum, which also scored the country highly for having one of the most advanced transport infrastructures in the region.

Key Actions Recommended

- With 64% internet penetration, and broadband and mobile internet speeds below the global median, South Africa should increase internet access to a broader cross-section of its population and improve the quality of the access.

- While 60% of South Africans engaged in digital payments in 2017, this number falls to 30% for the poorest 40%. Digital payments capabilities must be made more inclusive and more widespread.

- With 29% unemployment – and 55.2% among 15-24 years olds — and slowing GDP growth, job-creating digital businesses should be promoted.

- Policies to follow through on President Ramaphosa’s commitment to a “skills revolution” – including creative and multimedia skills — must be prioritized.

Kenya

Home to what’s known as a “Silicon Savanah” in Nairobi, Kenya has a growing, tech-savvy ecosystem. Thanks to the popularity of M-Pesa, the mobile payments capability offered by Safaricom, over 70% of Kenyans have a mobile money account, and over 75% of Kenyans aged 15 or older made a mobile payment in the last year. During the past decade, Kenya has advanced quickly as a hotspot for some of the continent’s most innovative digital enterprises, such as Ushahidi, M-KOPA, M-TIBA, etc. There are 200 digitized services offered through Huduma E-Centers countrywide and a comprehensive online government-to-citizen services platform, eCitizen. Kenya’s policymakers have enabled a favorable regulatory environment, and have promoted a high use of digital payments.

Key Actions Recommended

- A Kenyan born today is likely to achieve at most 52% of their potential if they survive to adulthood because of gaps in the education and health systems. Investments in policies to promote education, digital skills and healthcare must be prioritized.

- Investments in basic infrastructure, to reduce power outages and other disruptions must be made.

- Despite its leadership with M-Pesa, cash accounts for 71% of Kenya’s total payments, primarily because non-consumer payments are disproportionately in cash. Kenya has enormous potential for the digitization of payments involving businesses.

- Digitization barriers in the value chain, such as lack of credit, user experience issues, and informal economy challenges should be addressed; agriculture and food & beverage sectors offer the best opportunities.

Rwanda

Rwanda has been moving to transform itself into a digital hub, with several notable initiatives, including Irembo, a government-to-citizen services e-portal, high mobile account usage, expanded 4G coverage across the country, and improved digital skills. Rwanda’s Mara Group also became the first manufacturers of a smartphone made entirely in Africa. For example, 90% of Rwandans are within 5 km of a financial access point, due to the Umurenge SACCOs (USACCOs), established in 2008 to boost rural savings and to provide livelihood-enhancing loans to Rwandans. Also, Rwanda is has played a pioneering role in the region in exploring several key emerging technologies, such as drones used to deliver critical supplies to inaccessible areas or considering a central bank issued digital currency.

Key Actions Recommended

- Rwanda’s mobile money adoption rates, while high, can still be improved. There are three mobile operators offering mobile money services, but the banks still need to develop their strategies.

- Irembo can achieve its full potential through policies that improve digital education, connectivity, and acceptance and authentication of e-certificates.

- Policies must prioritize bridging the urban-rural digital divide, and in reducing electricity, water, and transport infrastructure disruptions. They must also address the highly fragmented markets, poor document management and payment tracking methods, and the interoperability between USACCOs and mobile money operators.

- USACCO operations need to be improved to reduce leakages and theft, improve efficiencies, and increase the profitability of the cooperatives.

Egypt

The digital technology sector is Egypt’s second-fastest growing sector. The country is also producing a large number of skilled graduates; it has the highest number of tertiary graduates of the countries we studied. Egypt is a regional leader in skilled digital jobs creation with online freelancer pools in creative and multimedia, software development and technology, and in writing and translation. With 50% of its population below the age of 30 and a massive e-commerce market, Egypt is also developing one of the region’s fastest growing entrepreneurial hubs.

Key Actions Recommended

- With only 8% of Egyptians over 15 years of age having made a digital payment in the last year, policies to promote the use of digital payments must be implemented. The recent law requiring most payments over 500 Egyptian pounds ($29) to government, and most of the salaries and fees paid out by public and private entities, be made electronically is an example, but other actions are needed.

- With one of the weakest records on online freedoms in the Middle East, Egypt can create opportunities in digital media by relaxing internet censorship rules.

- The high frequency of internet disruptions and website blocking must be decreased.

Nigeria

Nigeria has a powerful entrepreneurial climate, with innovative ventures such as Jumia, Interswitch, Kobo360, and Andela as the outcomes. These ventures cut across the education, fintech, agriculture, healthcare, logistics, and travel. Nigeria was Africa’s leading startup investment destination in 2018, recording nearly $95 million in deals. Lagos’ Yaba neighborhood has even earned the nickname “Yabacon Valley.” The relative affordability of Nigeria’s internet is key: The Economist ranks it first in affordability in the region. The government’s National Identity Management Commission is set for a massive registration for the country’s mandatory National Identity Number (NIN). A unique identity system is essential in developing countries, where the vast majority have few other ways to prove who they are and thereby get access to public services or the financial system, usually through a mobile phone.

Key Actions Recommended

- Nigeria must improve on its use of digital payments. Some 87% of Nigeria’s economy is transacted in cash and most Nigerians had never heard of mobile money. Policies to stimulate greater mobile money use will be important — in 2018, the central bank allowed telecoms and supermarkets to be “payment service banks,” and take deposits and make payments by digital means, but the practice needs to become mainstream.

- Policies to facilitate digitization must adapt to many challenges, which, themselves, must be addressed over time. There is a high frequency of power outages, low level of public trust in technology, and a large informal economy (65% of GDP and 80% of workforce).

- Nigeria’s sizable super-wealthy community should be better encouraged to participate in early-stage and angel investments in digital startups.

Ethiopia

While it has the most ground to cover among the six countries studied, Ethiopia is experiencing positive developments in several areas that can facilitate digitally enabled growth. Prime Minister Abiy Ahmed, who won the 2019 Nobel Peace Prize, has a background in and understanding of the tech sector and has been implementing reform in a number of sectors, including privatization of several state-owned entities. Ethiopia has also been upgrading its infrastructure, with a $20 billion investment in the power sector. Overall enrollment in higher education facilities in the country have grown five-fold since 2005, and the government has a policy of training 70% of students in STEM; so the human capital base is strong. With a fast-emerging tech hub, also known as ‘Sheba Valley,’ the country has had several homegrown ride-hail ventures, Ride and ZayRide, startup marketplaces, Gebeya and BlueMoon, as well as an agtech incubator and seed fund. Ethiopia can leverage advances in adjacent areas: there is a growing manufacturing industry and use of advanced technologies, such as blockchain use in tracking the supply chain and enhancing trade in coffee beans.

Key Actions Recommended

- With only 15% of its population online, low spread of 3G and 4G technologies, and low use of digital payments (only 12% of the population over 15 years of age made or received a digital payment in 2016) , there is plenty of headroom for digital growth. Ethiopia must close a deep digital divide, invest in basic infrastructure, and facilitate competition. Internet access needs to be made more affordable and reliable for the average Ethiopian.

- Privatization of key sectors can help catalyze competition and an entrepreneurial climate. A key development that could lead the way is the privatization of the telecoms sector

- The country is almost entirely reliant on cash, and would benefit from a regulatory environment that builds trust in digital money

- Ensuring reliability of the key infrastructure should be prioritized. An unreliable power supply, along with intentional internet shutdowns during anti-government protests, states of emergency, or to limit exam cheating, are all primary barriers to the country’s digital evolution.

Implications for Africa’s economic growth

The recently announced African Continental Free Trade area went into force in May 2019. The agreement could, in principle, create a single market of over a billion consumers with a total GDP of over $3.4 trillion, making Africa the largest free trade area in the world. There are differing motives for pan-African cooperation across countries. For some countries, such as Nigeria, that are dependent on global markets, the incentives to be participate are weaker, while a country like South Africa would have a stronger interest in a pan-African market.

As our analysis has shown, the digital advantages and gaps of different countries vary widely. A free-trade zone could help in collaborative initiatives, such as the benchmarking described here, to close the gaps and transfer knowledge across countries to enable the delayed promise of growth in Africa and helping make the growth inclusive – thereby accomplishing that rare phenomenon of getting lions to leapfrog.