PTC Is a Top Stock to Buy for Industrial Technology in 2023 – The Motley Fool

It’s been a while since I’ve caught up with PTC (PTC -0.89%) — spring 2021, to be exact. Since then, the maker of computer-aided design (CAD) software has done well, growing its revenue and profitability by a double-digit percentage.

The only problem is that its shares have fizzled, selling off after a surge in optimism around a government infrastructure spending bill that would ultimately become the scaled-back $1.2 trillion Infrastructure Investment and Jobs Act.

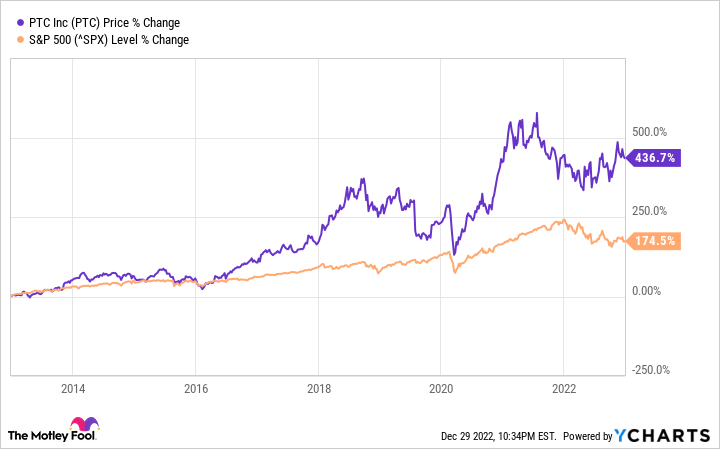

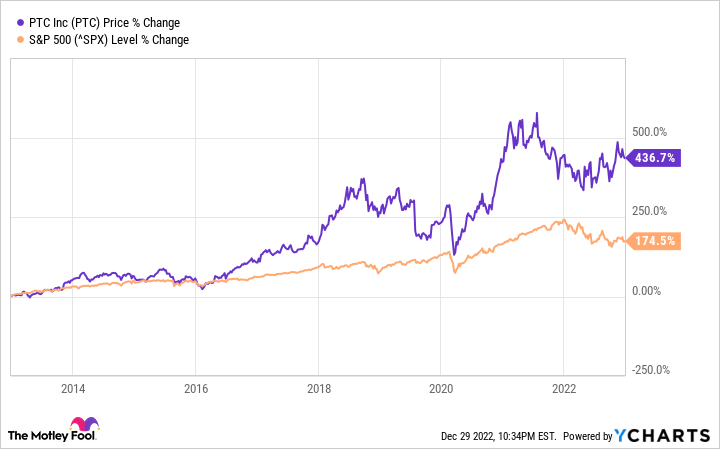

Nevertheless, after over a decade of focus on asset-light software, the company’s investment into hard assets is here and could continue for the next few years. After tumbling for most of 2021, PTC stock ended flat in 2022 and handily beat the market. If you’re looking for a way to buy into a boom in infrastructure spending, PTC could be the industrial technology stock for you.

Help wanted: AI and automation

Subsequent to the U.S. infrastructure bill, government spending has also been approved via the Inflation Reduction Act, as well as through the CHIPS Act. What has been deemed “infrastructure” these days might be controversial, but these recent spending bills have ample funding aimed at manufacturing, industrial technology, and energy. Infrastructure-upgrade needs are even more acute overseas.

But in a tight labor market, many companies aren’t able to fill a lot of the job openings they have. And with the economy headed for a possible recession in 2023, many businesses have begun thinking about doing more with less. That’s where a company like PTC can come into play.

PTC is a software subscription company catering to engineering, design, and product management — in a similar category to CAD companies like Autodesk (ADSK -0.66%) and simulation software specialist Ansys (ANSS -0.81%). Some of PTC’s software products address CAD basics, but also some high-tech initiatives, like Industrial Internet of Things management, additive manufacturing (3D printing), and augmented-reality software, which can be used to increase worker productivity.

The common theme among all of these solutions is helping engineering, manufacturing, and industrial businesses get more efficient via artificial intelligence (AI) and automation. It’s a suite of software that has already been doing quite well.

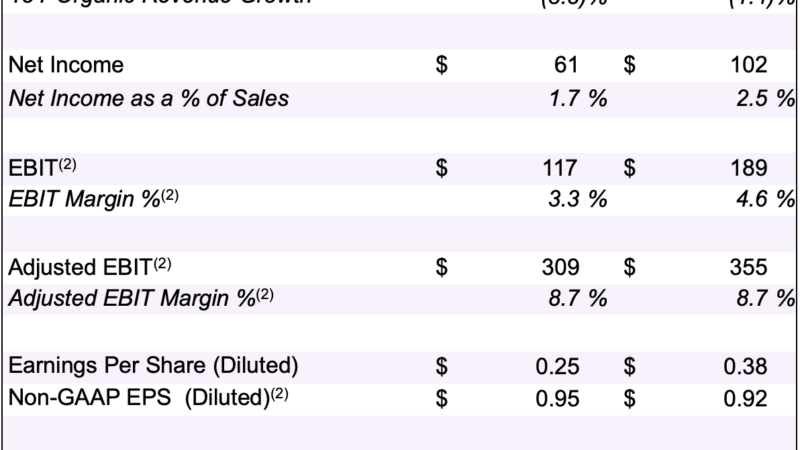

In the recently concluded 2022 fiscal year, PTC reported organic growth in annualized recurring revenue (excluding a small acquisition) of 6% to $1.56 billion. When excluding the impact of a record run-up in the U.S. dollar (due to the Federal Reserve’s big interest rate hikes), annualized recurring revenue would have grown 16%.

In spite of headwinds, though, free cash flow jumped 21% in 2022 to $416 million as PTC focused on unlocking profitable expansion from its operations.

A rosy outlook for 2023 and beyond

PTC has been a great growth story over the last decade, boosting revenue an average of 15% a year and simultaneously increasing its adjusted operating profit margin from 16% in 2010 to 38% in 2022. Management thinks a similar dynamic can play out in the coming years as computing technology begins to overhaul the industrial economy in earnest.

Data by YCharts.

For fiscal 2023, PTC expects its annualized recurring revenue to increase in a range of 10% to 14% (when excluding currency exchange rates and its pending acquisition of software company ServiceMax). Free cash flow is expected to be up about 35% to $560 million as the company continues to eat its own cooking and “do more with less.” In a more-severe macroeconomic scenario (a recession), PTC sees annualized recurring revenue up just 7% or flat with 2022. Not bad, considering that the cyclical industrial and manufacturing sector tends to get hit especially hard by an economic downturn. Clearly, PTC’s services are in high demand.

As is the case with many software companies, PTC has a stock-based compensation issue. Stock paid to employees tallied up to $175 million in the last year. But much of this was offset by $125 million in share repurchases. Whether on an unadjusted net income or a free-cash-flow basis, PTC is profitable and able to manage this noncash expense, so it doesn’t unduly dilute shareholders.

Shares trade for 46 times trailing-12-month earnings and 35 times trailing-12-month free cash flow. It’s a steep premium that anticipates a big rebound in PTC’s realized profits in 2023, as well as double-digit-percentage earnings growth for years to come. Based on this assumption (about 20% earnings-per-share growth in the next two years before settling into a high-single-digit percentage thereafter), I think PTC is fairly valued right now.

Because of the premium price tag, I’d advise caution about buying a position all at once. If you choose to buy, use a dollar-cost-averaging strategy to build a position over time. Nevertheless, I believe PTC can deliver as it grows organically and via acquisition in the coming years. Industrial technology and automation are likely to be key investment themes, so keep this software technology provider on your radar.