New Oriental Education & Technology Group (EDU) Q2 2023 … – The Motley Fool

Image source: The Motley Fool.

New Oriental Education & Technology Group (EDU -11.98%)

Q2 2023 Earnings Call

Jan 17, 2023,

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Operator

Good evening, and thank you for standing by for New Oriental’s fiscal year 2023 second-quarter results earnings conference call. At this time, all participants are in listen-only mode. After management’s prepared remarks, there will be a question-and-answer session. Today’s conference is being recorded.

If you have any objections, you may disconnect at this time. I would now like to turn the meeting over to your host for today’s conference, Ms. Sisi Zhao.

Sisi Zhao — Director, Investor Relations

Thank you. Hello, everyone, and welcome to New Oriental’s second fiscal quarter 2023 earnings conference call. Our financial results for the period were released earlier today and are available on the company’s website, as well as on Newswire services. Today, Stephen Yang, executive president and chief financial officer, and I will share New Oriental’s latest earnings results and business updates in detail with you.

After that, Stephen and I will be available to answer your questions. Before we continue, please note that the discussion today will contain forward-looking statements made under the Safe Harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements involve inherent risks and uncertainties.

10 stocks we like better than New Oriental Education & Technology Group

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and New Oriental Education & Technology Group wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of January 9, 2023

As such, our results may be materially different from the views expressed today. A number of potential risks and uncertainties are outlined in our public filings with the SEC. New Oriental does not undertake any obligation to update any forward-looking statements except as required under applicable law. As a reminder, this conference is being recorded.

In addition, a webcast of this conference call will be available on New Oriental’s investor relations website as an investor.neworiental.org. I will now first turn the call over to Mr. Yang Stephen. Please go ahead.

Stephen Yang — Executive President and Chief Financial Officer

Thank you, Sisi. Hello, everyone, and thank you for joining us on the call. This second quarter is a successful faithful manifestation as we have turned over a new leaf in our business and embarked on innovative journey for rich business opportunities since the beginning of fiscal year 2023. Before going into details of our financial performance for this quarter, I would like to take this opportunity to extend our gratitude to those who have been believing and supporting New Oriental along the way. I’m delighted to share with you that after a year of restructuring process, New Oriental has successfully generated fruitful yields from our new business ventures, combined with our existing business and innovative business opportunity.

Despite the seasonality of some major businesses, which has historically resulted in a slower period for every second quarter, it’s immensely encouraging to see that we have achieved a meaningful profitability and better-than-expected margins in the second quarter. We have achieved a non-GAAP operating margin of 2.6% for this quarter. As compared to negative 112% in the same period of prior fiscal year, which was characterized by several [Inaudible] one-off expenses incurred from class cancellations, school closures, and employee layoffs. Our key remaining business have continued to demonstrate remarkable resilience.

In particular, overseas test prep business and overseas study consulting business have record remarkable year-over-year revenue increase as global COVID restriction eases and overseas study market is recovering. Our solid profitability strong performing remaining business lines and emerging new business initiatives in this quarter have again strengthened our confidence in preparing innovative — innovative endeavors and profitable growth through the rest of the year. Now, I would like to spend some time to talk about the quarter’s performance across our remaining business lines and new initiatives to you in detail. Our key remaining business have achieved promising trends, while our new initiatives have shown a positive momentum.

Breaking it down, the overseas test prep business reported a revenue increase of 17% in dollar terms, or 30% in RMB terms, year over year for the second quarter. The overseas study consulting business recorded revenue increase of about 14% in dollar terms, or 27% in RMB terms, year over year for the second quarter. The adults and university students business recorded a revenue decrease of 9% in dollar terms, or 2% increase in RMB, terms year over year for the second quarter. As for our new business initiatives, as mentioned in the past quarter, we have launched several new initiatives, which mostly revolve around facilities’ and students’ all-around development.

I’m glad to share with you that these new initiatives have further exceeded our expectations by sustaining a positive momentum and generating meaningful profits to the company. Firstly, the nonacademic tutoring business, which we have rolled out in over 60 cities, focus on cultivating students’ innovative ability and comprehensive quality. We are happy to see increased the market penetration in those markets we have tapped into, especially in higher-tier cities, with a total of 477,000 enrollments recorded in this quarter. The top 10 cities in China have contributed about 60% of the revenue of this business.

Secondly, the intelligence learning system and device business is a service designed to provide a tailor — tailored digital learning experience for students. It utilizes our powerful teaching experience, data, and technology to provide a personalized, targeted learning exercise content. Our continuous investments in technology has built a competitive edge, which drives our navigation amid a chain of challenges from last year. Together with the — our teachers monitoring and accessing the learning curve for students of the back-end system, this new innovative educational service, not only greatly improve students learning efficiency, but also cultivates students’ productive learning habits.

We have passed this adoption in over 60 cities with 108,000 active paid users in this quarter and are delighted to see improved customer retention and scalability of this new business. The revenue contribution from top 10 cities in China is around 60%. Last but not least, our smart education business, which comprises smart teaching, smart hardware, science technology innovation education and other services, serves local governments, education authorities, schools, and kindergartens. Our educational material utilizes a smart study solution, a self-learning system, which leverages advanced technology, enables students to have complete control over the pace and the flexibility of learning in an age where remote learning becomes increasing increasingly mainstream.

We also offer exam prep courses designed for students with junior college diplomas to obtain bachelor’s degrees. The above-mentioned business have been gaining wide traction and contribute to the overall growth of the company and have attained instrumental profits since the last quarter. Coming to our OMO system, we are continuously investing, developing, and revamping our OMO teaching platform and have leveraged our educational infrastructure and technology strength over the remaining business and new initiatives to provide a more advanced and diversified education service to our customers for all ages. Our OMO system has been a core support to our business, especially with some of the strict social control measures that were implemented in the past months.

We have invested a total of $21 million in the quarter on our OMO teaching platform, which provides us the flexibility to continue to offering high quality service to students during the pandemic. Now, I would like to give you all updates on Koolearn’s latest performance. In the first half of this fiscal year, Koolearn has achieved instrumental breakthroughs in both business operations and financial performance. This significant progress was made as a result of Koolearn’s strategic transformation from focusing our online education to livestreaming e-commerce.

In 2021, Koolearn expanded its livestreaming e-commerce business and established Dongfang Zhenxuan, which has since become a well-known platform for promoting healthy, top-quality, and cost-effective products to the public. The platform has formed part of the tight supply chain management and after-sales service system, which strictly abided by a set of relevant laws and regulations. Leveraging our deep understanding of customer needs, Dongfang Zhenxuan continues to expand its product selection and SKUs through proactive cooperation with third parties coupled with the development of our Dongfang Zhenxuan private label products. The platform’s business development has gratefully benefited from the maturity of China’s social infrastructure and the contributions and support from the community.

To summarize the Koolearn fruit-bearing growth and profitability with our financial performance, for the first six months of this fiscal year, Koolearn reported revenue approximately 2,080.1 million RMB, which represents a 590.2% increase from revenues from continuing operations of 301.4 million in the same period of last prior fiscal year. Koolearn recorded 585.3 million RMB of net profit, a 638.5% increase from the net — from net loss from the continuing operation of 108.7 million in the same period of prior fiscal year. In the first six months of fiscal year, the gross profit of Koolearn reached [Inaudible] 982.5 million RMB, accounting for 47.2% in terms of the GP margin. As we continuously map the platform’s strategic transformation, the fast-growing Dongfang Zhenxuan also committed to give back to customers and the community.

Since its launch, Dongfang Zhenxuan has stood firm to not charge commissions from customers or any fees. It has always taken close reference to industry standards, focusing on establishing the mostly beneficial long-term collaboration with the various parties so as to maximize benefits for customers. Dongfang Zhenxuan also ensures a trend of cost-effective performance as one of its development principles. On one hand, Dongfang Zhenxuan focused on enhancing product capability while continuing to establish its cultural social content.

On the other hand, Dongfang Zhenxuan has also organized to diversify of the diverse outdoor livestreaming activities to promote the special agriculture products and to contribute to the cultural tourism. Through this unyielding aspiration to create value in related industries, which have also attracted and retained a larger pool of talent, cooperators, as well as followers and members, Dongfang Zhenxuan has successfully received, in return, millions of revenues and a loyal customer base during the reporting period. With regard to the company’s latest financial position, I’m confident to share with you that the company is seeing a healthy financial status with cash and cash equivalents, term deposits, and short-term investments totaling approximately $4.2 billion. On July 26th — on July 26th, 2022, the company’s board of directors authorized a share repurchase of up to $400 million from the company ADS or common shares during the period from July 28, 2022 through May 31st, 2023.

As of January 16th, 2023, the company repurchased aggregate of approximately 3.1 million ADS for approximately $79 million from the open market and the share repurchase program. Now, I will turn the call over to Sisi to share with you about the key financials. Sisi, please go ahead.

Sisi Zhao — Director, Investor Relations

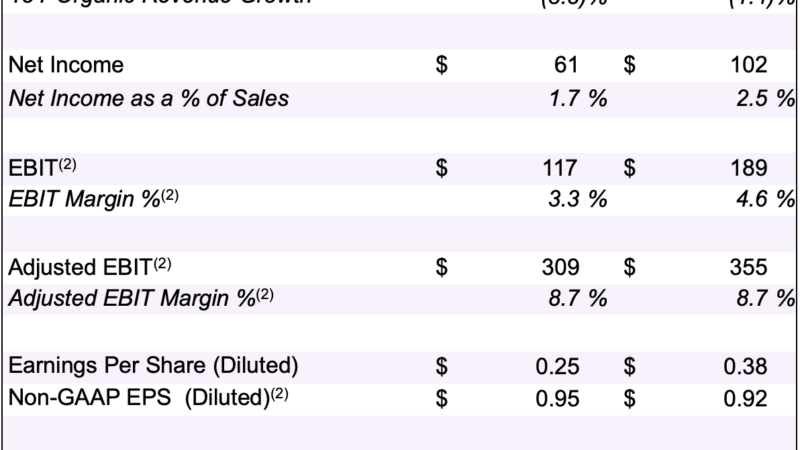

OK. Now, I’d like to walk you through the other key financial details for this quarter. Operating cost expenses for the quarter were $640.7 million, representing a 55.1% decrease year over year. Non-GAAP operating costs and expenses for the quarter, which excludes share-based compensation expenses, were $621.9 million, representing a 55.4% decrease year over year.

The decrease was primarily due to the reduction of facilities and number of staff as a result of the downsizing in the fiscal year 2022. Cost of revenue decreased by 31.6% year over year to $336.2 million. Selling and marketing expenses decreased by 15% year over year to $95.5 million. G&A expenses for the quarter decreased by 74.6% year over year to $209 million.

Non-GAAP G&A expenses, which exclude share-based compensation expenses, were $190.9 million, representing a 75.7% decrease year over year. Total share-based compensation expenses, which were allocated to a related operating costs and expenses, decreased by 39.5% to $18.8 million in the second fiscal quarter to 2023. Operating loss was $2.5 million, comparing — compared to a loss of $768.1 million in the same period of prior fiscal year. Non-GAAP income from operations for the quarter was $16.3 million, compared to a loss of $737.1 million in the same period of prior fiscal year.

Net income attributable to New Oriental for the quarter was $0.7 million, represent — compared to the loss of $936.5 million in the same period of last year –last fiscal year. Basic and diluted net income per ADS attributable to New Oriental were zero and $0 respectively. Non-GAAP net income attributable to New Oriental for the quarter was $17.8 million, compared to the loss of $901.6 million in the same period of last year. Non-GAAP basic and diluted net loss per ADS attributable — attributable to New Oriental was $0.11 and $0.10 respectively.

Net cash flow generated from operations for the second fiscal quarter of 2023 was approximately $173.7 million, and capital expenditure for the quarter were $11.4 million. Turning to the balance sheet. As of November 30, 2022, New Oriental has cash and cash equivalents of $1,029.9 million. In addition, the company has $1,033.2 million in term deposits and $2,145.7 million in short-term investments.

New Oriental’s deferred revenue balance, which is cash collected from registered students for courses and recognized proportionally as revenue as the instructions were delivered at the end of the second quarter of fiscal year 2023 was $1,139.1 million, an increase of 6.9% as compared to $1,065.8 million at the end of the second quarter of fiscal year 2022. Now, I’ll hand over to Stephen, again, to go through our outlook and guidance with you.

Stephen Yang — Executive President and Chief Financial Officer

Thank you, Sisi. Looking ahead into the rest of fiscal year 2023, with the restructuring process largely completed and our new business in the early stage, we expect our school network and geographic coverage to stabilize. The company remains tireless in seeking new opportunities with greater flexibility and strong cash flows. We’re confident in the sustainable profitability of all our remaining key businesses, as well as the growth and prospect of our new initiatives.

For our new business, as we observed in the first half of this fiscal year, the encouraging performance that these businesses have achieved proves that we are heading toward the right direction. And we firmly believe that business will be able to maintain an upward growth trajectory and generate meaningful profits to the company in fiscal year 2023. As for evolving pandemic development in China since late November in 2022, many cities are experiencing certain levels of disruption on business operations. Although we are expecting a negative impact on our financials in the coming one or two quarters, we remain confident and optimistic that overall impact will be temporary and manageable.

Hence, we expect total net revenue in the third quarter of the fiscal year 2023 to be in the range of $702.8 million to $719.8 million, representing a year-over-year increase in the range of 14% to 17%. The projected increase of revenue, in our functions — functional currency RMB is expected to be in the range of 24% to 27%. As the profitability we recorded in this fiscal quarter has reaffirmed our success and dedication in turning a new page and generating profit for the rest of the year. Bottom line-wise, we’re confident in achieving greater operating profit in the full year of fiscal year 2023.

To conclude, we are now taking multipronged operational actions to promote our key remaining businesses while we cautiously invest in new initiatives, which will remain new growth engines that accelerate our recovery and pursue the profitable growth. At the same time, we’ll continue to seek guidance guidance from and cooperate with government authorities in various provinces in China, in alignment with the efforts to comply with the relevant policies and regulations, as well as to further adjust our business operations as required. I must say that these expectations and forecasts reflect our considerations of the latest regulatory measure, as well as our current and the preliminary view, which is subject to change. This is the end of our fiscal year 2023 Q2 summary.

At this point, I would like to open the floor for questions. Operator, please open the call for these.

Questions & Answers:

Operator

The question-and-answer session of this conference call will start in a moment. In order to be fair to all callers who wish to ask questions, we will take one question at a time from each caller. If you have more than one question, please request to join the question queue again after your first question has been addressed. [Operator instructions] Please stand by while we compile the Q&A queue.

Our first question comes from the line of Felix Liu from UBS. Please go ahead. Your line is open.

Felix Liu — UBS — Analyst

Hi. Good evening, management. Congratulations on the strong top line, as well as the guidance. My question is on the COVID impact.

I know that COVID has come pretty viciously in December, but now we’re past the peak. So, I’m just wondering, how has COVID impacted our February quarter? If there is any quantifiable metric, that would be very helpful. And and my second question is growth expectation of our various businesses from here. If you were to rank the fastest to, you know, more stable business, how would you rank your various business segments? Thank you very much.

Stephen Yang — Executive President and Chief Financial Officer

Thank you, Felix. Yeah. As for the evolving pandemic in China, I think last December, yeah, I know the peak in the past writing. And, yeah, in many cities, I think, you know, some of our business are, you know, are negatively impacted.

But as our current estimation, I think the negative impact is small. And so, we remain confident and optimistic that the overall impacts from the pandemic will be temporary and manageable. And, yeah, you look at our guidance for Q3 is very, very strong. And the different business lines, the — I mean the — the revenue outlook for Q3, right — can you repeat the second question? Yeah.

Felix Liu — UBS — Analyst

Yes. So, maybe for Q3 and for the whole year, which are the business line that you think will grow the fastest, and which are the ones that are more stable?

Stephen Yang — Executive President and Chief Financial Officer

I think, you know, I think the — you know, we have two kinds of business. You know, the number one is the — the — the traditional business. The remaining business, you know, the overseas-related business, including the overseas test prep and consulting business, which contributes the 24%, 25% of the total revenue. What I’m saying is for the whole year, 24% to 25% of the total revenue.

I think the, you know — we suffered the negative impact from the last year. But this year, you know, I think we’re seeing the revenue growth is booming two quarters ago. And — and the new business within the schools, you know, we started the — we started the new business the last year, the year before last year, right, the, the November 2020. Yeah.

It is the last fiscal year. And, you know, the growth is, you know, we just started the business one year ago, and the growth is extremely high. So, this is the — the ranked number one, the revenue growth within all business lines. And also, we do have the Dongfang Zhenxuan.

And, yeah, Dongfang Zhenxuan, they reported the management of the Dongfang Zhenxuan report the first half year reports today. And you saw the growth and saw the numbers. And so, we are exciting for — the exciting performance for Dongfang Zhenxuan. And so, yeah.

The new businesses within the EDU side, the K-12 schools, and the Dongfang Zhenxuan are the two top performers within the business line, Felix.

Felix Liu — UBS — Analyst

Got it. Thank you, and congratulations on the results again.

Stephen Yang — Executive President and Chief Financial Officer

Thank you again.

Operator

Thank you. We’ll now move on to our next question. Please stand by. Our next question comes from the line of [Inaudible] Wang from CICC.

Please go ahead. Your line is open.

Unknown speaker

So, congrats on the profitable status for this quarter. And my question is, since COVID-19 restrictions have been lifted in China, do we expect a higher growth rate of our new business line in the next quarter and also in next fiscal year? And are there any new opportunities or a new initiated business? Thanks.

Stephen Yang — Executive President and Chief Financial Officer

Yeah. For the new business — yeah. As we saw in this quarter and the last quarter, the encouraging performance proves that we are heading toward the right direction. And, you know, we firmly believe the new business will be — we’ll be able to maintain upward growth in the Q3 and Q4 and the next fiscal year.

What I means is fiscal year 2024. And we started a new business in last year. But, you know, I think we ramped up the new business very quickly. And the good news for us is, you know, the margin for the new business in this quarter is already over 10%.

So, you know, the thing about that, we started this business last year, and it just spend like the three — two to three quarters to get at break even point and then we make profitable. So, it sounds very good. And I think we are on the — the good track. And I think the management of New Oriental will pay more efforts where it creates more opportunity — business opportunities to develop the new business as we did in Dongfang Zhenxuan, the new business, you know, in this year.

And so, we will do more — to do more creative in the future.

Sisi Zhao — Director, Investor Relations

Yeah. Actually, the new pandemic situation with the gradual opening up after these recent developments of the new situation, I think probably we can see more opportunities in — in some certain kind of new initiatives, such as the study tour and research camping business that we mentioned one to two quarters ago, that as one of the new initiative. But as the pandemic situation happened in one to two quarters, we did not have a very good chance to to roll out that business domestically. But with the new situation, we have confidence that there’s more opportunity for this business to perform better.

Unknown speaker

OK, thanks. That’s very helpful.

Operator

Thank you. [Operator instructions] Please stand by. [Operator instructions] Please stand by. Our next question comes from the line of Lucy Yu from Bank — BofA.

Please go ahead. Your line is open.

Lucy Yu — Bank of America Merrill Lynch — Analyst

Thank you. Thank you, Stephen, Sisi, for taking my question. Congratulation on a profitable quarter. Could you please give us some color on the revenue breakdown this quarter and as well as the margin profile for different business lines? I know, Stephen, you already mentioned, the new business is 10% OP margin.

How about the rest? Thank you.

Sisi Zhao — Director, Investor Relations

Yeah. For the reported quarter, the overseas-related business, including the overseas test prep and consulting, contributed roughly about 21% of total revenue. And the domestic test prep, the adult university students business, contributed roughly about 6%. And the school business, including our remaining high school business and also the new initiatives for younger students, together, contributing roughly about over 40% of total revenue.

And the rest are Koolearn and some other businesses. So, that’s the rough contribution. Yeah.

Stephen Yang — Executive President and Chief Financial Officer

Yeah. Lucy, I just want to share with you the — the margins by different business lines. You know, the overseas-related business, overseas test prep, combined with the consulting business, the margin for the whole year, fiscal year 2023 will be around 10% to 15% margin. What I’m saying, the margin is before the company already had.

And the adults and the university study business, I think the margin profile — you know, I think the business will be — will be the break even in this year. And the school business, including the remaining business and the new initiatives, you know, as Sisi said, contributed 45% of the total revenue. The margin should be somewhere around 20 — 20% to 25% or even a little bit higher. And so, the others — this is the big others, including the Koolearn, Dongfang Zhenxuan and others, I think, you know, if you follow the numbers, the Koolearn, first half the year report, I think you will see more the color on the margin profile of the Koolearn and others.

Yeah, Lucy.

Lucy Yu — Bank of America Merrill Lynch — Analyst

Thank you, Stephen. Thank you, Sisi. Could you also also talk about a y-o-y growth for different business lines in this quarter? Thank you.

Stephen Yang — Executive President and Chief Financial Officer

Year over year, I think that the revenue contribution —

Sisi Zhao — Director, Investor Relations

Yeah, we talked about it in the prepared remarks. So, for this quarter, like U.S.-dollar term, overseas test prep business increased by roughly 17%. Actually, for RMB term, you should add another 10%, 15% more. The university students business is stable.

And U.S.-dollar term is negative 8%, but RMB term is positive. And the — yeah, the school business actually increased because of the new initiatives. And also Koolearn and other business increased a lot.

Lucy Yu — Bank of America Merrill Lynch — Analyst

Thank you so much.

Operator

Thank you. We’ll now take our next question. Please stand by. Our next question comes from the line of Candis Chan from Daiwa.

Please go ahead. Your line is open.

Candis Chan — Daiwa Capital Markets — Analyst

Hi, Stephen. Hi, Sisi. Congratulations on the very strong set of results and also the strong guidance for next quarter. So, my first question is related to the third-quarter revenue guidance and also the profitability that we are aiming for.

So, firstly, can you give us a rough breakdown of revenue for the quarter? And also, in terms of the operating margin, how should we look at it for the third quarter given — given the strong revenue? Thank you.

Stephen Yang — Executive President and Chief Financial Officer

OK. In the Q3 forecast, you know, I think the number one, the overseas-related business, test prep and consulting business will contribute 24%, 25% of total revenue in — in Q3. And — and the second, the adults and the university students business contributed 2% of total revenue because of the COVID, you know. And the school business, including the traditional business, the remaining business, and that the new initiatives will contribute to 43% or 44% of total revenue.

And the other 30% comes from the Koolearn, Dongfang Zhenxuan, and the other business like the books or the other, the [Inaudible] business. And the — and the margin profile — you know, I think the margins — you know, we — I think we — let us start the margin analysis from this quarter. In Q2, you saw our GP margin and OP margin increased a lot compared to last year. And I think this is mainly driven by four reasons.

The number one is, last year, Q2, even for the whole year on the first three quarters, we had the considerable one-off cost related to class cancellation, the learning center closures, and the new staff lay offs. In this quarter, even in the fiscal year, we have no one-off cost. Number two, I think the downside to the learning center numbers, you know, led to the lower fixed costs. So, it drives the margin up per learning center.

Number three is, you know, the new businesses, the margin is over 10% this year. I think it’s good news for us. And also the recovery of the remaining business, for example, like the overseas-related related business generated a higher margin than that of last year. And the last reason, the number four, is the Dongfang Zhenxuan, the Koolearn, the last stream e-commerce business enjoys higher margin.

So, it’s makes the margin, you know — it drives the margin up for the whole group. And going forward, I think for all of this business lines, we are — will contribute, you know, higher profit and drive the whole margin up year over year. So, we are quite optimistic of the — the margin profile of the whole year, fiscal year 2023.

Candis Chan — Daiwa Capital Markets — Analyst

Great. Thank you, Stephen. So, my — my second question is related to the regulations recently. In late December that we saw that there is a new document about nonacademic tutoring activities.

So, do we see an impact on our — on our business overall like in terms of pricing and also the expansion? Thank you.

Stephen Yang — Executive President and Chief Financial Officer

Yeah. Actually, since the government has issued the policy last year, I think we have been actively exploring the new business direction and follow all the central and local government authorities, the rules. And so, yeah. You mentioned the new rules in last October — in October last year.

I think there will be no material impact actively impact our business.

Candis Chan — Daiwa Capital Markets — Analyst

Thank you very much.

Stephen Yang — Executive President and Chief Financial Officer

Thank you.

Operator

Thank you. We’ll move on to our next question. Please stand by. We have a follow-up question from the line of Felix Liu from UBS.

Please go ahead. Your line is open.

Felix Liu — UBS — Analyst

Hi, Stephen and Sisi. My follow-up question is on your learning center network. I noticed you opened two centers in this quarter. So, I think that’s a good step forward, although a small step.

Could you share some color on your expansion outlook from here, maybe this year and next year? Thank you.

Stephen Yang — Executive President and Chief Financial Officer

I think in the rest of this fiscal year, I think we have no big plan to set up new learning centers. I think the learning center number will be stabilized because we invest a lot on OMO system in last — in past so many years, and we moved a lot of costs from the offline to online. So, it’s safety classroom the areas. And also — and we changed some of the traditional business classroom areas to the new businesses.

So, this is the internal change. And the next year, we do hope we open more learning centers. And — but so far, I think it’s too early to say how many learning centers we set up for the new year because we have not finished the new year budget. I think I want to share with you the new learning center expansion plan next quarter — next-quarter earnings call.

Felix Liu — UBS — Analyst

OK, great. Thank you.

Operator

Thank you. [Operator instructions] Our next question comes from the line of [Inaudible] from HTSC. Please go ahead. Your line is open.

Unknown speaker

Hi. Good evening, Stephen and Sisi. My question is about the ratio on teachers to students. Could you share some color on the teacher to student ratio on each learning service segment? Thank you.

And do you have more plan to recruit more teachers in the next two years? Thanks.

Stephen Yang — Executive President and Chief Financial Officer

I can share with you the teachers number. You know, by the end of this quarter, we have 26,000 teachers in total and because we started a new business just since the last year. So, I think it’s too early to like calculate the teachers to student ratio. I think maybe next quarter, in the new year, we’ll disclose the ratio.

And yeah, we — I think we are hiring new teachers because we started with new businesses. And for some nonacademic courses or the other new business, we do need to hire more teachers. And — but the key is we want to hire more teachers. So, we care more about the utilization and the efficiency of the whole company.

So, I think we believe we will keep the higher utilization and the higher the operation efficiency for the whole company in the future. Thank you.

Unknown speaker

Thank you.

Operator

Thank you. We’ll now move on to our next question. Please stand by. Our next question comes from the line of DS Kim from JPMorgan.

Please go ahead. Your line is open.

DS Kim — JPMorgan Chase and Company — Analyst

Hi, Stephen. Hi, Sisi. Happy New Year, and congrats on your strong results. I actually just have one quick follow-up question on all your comments regarding margins.

Can I ask how much of corporate overhead shall we expect at this stage, i.e., I remember corporate overhead used to be like high single digit-ish of revenue predouble reduction policy like a few years back. But given much smaller or reasonably smaller revenue base now, I’m wondering how much of overhead we should model and expect for this year either as a percentage of revenue or dollar term would be appreciated.

Stephen Yang — Executive President and Chief Financial Officer

Yeah. I think since the last year, we would cut off some fixed cost and expenses in the headquarters. So, I think the headquarters expenses as a percentage of the total revenue will be stabilized and roughly 6% to 7% of total revenue. This is the total expense from other quarters.

DS Kim — JPMorgan Chase and Company — Analyst

Thank you. That’s a very impressive and great margin guidance. If I may follow up, again, on all your comments on the expansion plan, I don’t want to ask too much about the number of learning centers. But may I check for nonsubject tutoring classes, like where do we see incremental demand opportunity, say, top-tier cities, top 10 cities versus the rest of the nation? Like where do you see stronger demand? And where do you think we will open more store — more centers in terms of the geographical exposure? And that’s all for me.

Thank you again for taking my questions.

Stephen Yang — Executive President and Chief Financial Officer

I think the new business development in the top-tier cities is a little bit better than the low-tier cities. And this is — we have seen in the past quarters. And — but I do believe the — even in some low-tier cities, I think they will catch up because they started the business a little bit slower than the top-tier cities. And so, in almost everywhere, we are seeing the business opportunities for the nonacademic courses, almost everywhere.

And yes, that’s all. Yeah, capacity. Yes. As I said, now, we don’t have the capacity expansion plan.

And we just want to keep the same learning center numbers at the next quarter or even for the — until the end of this fiscal year. And next year, maybe we’ll spend — we will extend some new learning centers. But so far, we don’t — we haven’t finished the next year budget. I will share with you the numbers next quarter — next quarter.

OK.

DS Kim — JPMorgan Chase and Company — Analyst

Thank you, sir.

Operator

Thank you. We’ll now move on to our next question. Please stand by. Our next question comes from the line of [Inaudible] Wang from CICC.

Please go ahead. Your line is open.

Unknown speaker

Hi, Stephen and Sisi. I have a follow-up question. I noticed that there’s a significant increase in nonacademic tutoring enrollments in Q2. Would you like to specify the driver behind? And do we have any target for the enrollments during the whole year? Thanks.

Stephen Yang — Executive President and Chief Financial Officer

I think the market is always there. And we do have the [Inaudible] brands, and we do have the teachers. And, yeah, we started the business just a year ago that you saw the numbers. And the exciting news for us is that the profit of the new business is exciting.

It’s much better than expected. And for the new business, I do believe in the rest of this fiscal year, the new business, the revenue growth will be accelerated again. And even for the next new year, fiscal year 2024, I do believe the business of the new — the revenue growth of the new business will be high. Yeah.

So, we’re optimistic about the nonacademic tutoring business.

Sisi Zhao — Director, Investor Relations

Yeah. And by the way, the nonacademic tutoring business, according to our experience in the last several quarters, we think that its seasonality is not that apparent as some other test prep business. So, every quarter, probably the enrollments will be relatively stable if you do the Q-on-Q comparison. And also as new business development in all the local cities, probably you can see strong momentum.

As we have seen that Q2’s growth or the enrollment trends are also similar or even better than Q1. Yeah.

Unknown speaker

Yeah. I see. That’s very clear. Thank you.

Operator

Thank you. We’ll now go to our next question. Please stand by. We have a follow-up question from the line of [Inaudible] from HTSC.

Please go ahead with your question.

Unknown speaker

Just one more follow-up question. Do we have any color on the retention rate for each segment?

Stephen Yang — Executive President and Chief Financial Officer

Actually, retention rates is related to the traditional — the K-12 business. But we closed on the K9 business last year. And — but for new businesses like nonacademic courses, we just follow up — we just retrieved the retention rate. The good news for us is we are seeing the retention rate is getting higher and higher.

And for example, for — as for the nonacademic courses, the retention rate now is between 65% to 70%. We just started the new business as the retention rate now is better than we expected. And we believe the retention rate will get higher going forward. And overseas test prep and the adults — the university students business —

Sisi Zhao — Director, Investor Relations

One-off.

Stephen Yang — Executive President and Chief Financial Officer

Yeah, that’s one. Roughly, it’s one-off.

Unknown speaker

Understood. OK. Thank you. It’s very clear.

Operator

Thank you. We are now approaching the end of the conference call. I will now turn the call over to New Oriental’s executive president and CFO, Stephen Yang, for his closing remarks.

Stephen Yang — Executive President and Chief Financial Officer

Again, thank you for joining us today. If you have any further questions, please do not hesitate to contact me or any of our investor relations representatives. Thank you.

Duration: 0 minutes

Call participants:

Sisi Zhao — Director, Investor Relations

Stephen Yang — Executive President and Chief Financial Officer

Felix Liu — UBS — Analyst

Unknown speaker

Lucy Yu — Bank of America Merrill Lynch — Analyst

Candis Chan — Daiwa Capital Markets — Analyst

DS Kim — JPMorgan Chase and Company — Analyst