MACOM Technology Solutions Holdings (MTSI) Q2 2020 Earnings Call Transcript – Motley Fool

Image source: The Motley Fool.

MACOM Technology Solutions Holdings (NASDAQ:MTSI)

Q2 2020 Earnings Call

Apr 29, 2020,

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Operator

Good afternoon, and welcome to MACOM’s second fiscal quarter 2020 conference call. This conference call is being recorded today, Wednesday, April 29, 2020. [Operator instructions] I will now turn the call to Mr. Steve Ferranti, MACOM’s vice president of investor relations.

Mr. Ferranti, please go ahead.

Steve Ferranti — Vice President of Investor Relations

Thank you, operator. Good afternoon, and welcome to MACOM’s second fiscal quarter 2020 earnings conference call. I would like to remind everyone that our discussion today will contain forward-looking statements, which are subject to certain risks and uncertainties as defined in the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those discussed today.

For more detailed discussions of the risks and uncertainties that could result in those differences, we refer you to MACOM’s filings with the SEC. Management’s statements during this call will include discussions of certain adjusted non-GAAP financial information. A reconciliation of GAAP to adjusted non-GAAP results are provided in the company’s press release and related Form 8-K, which was filed with the SEC today. And with that, I’ll turn over the call to Steve Daly, president and CEO of MACOM.

Steve Daly — President and Chief Executive Officer

Thank you and good afternoon. I will begin today’s call with a general company update. After that, Jack Kober, our chief financial officer, will provide a more in-depth review of our fiscal 2020 Q2 financial results. When Jack is finished, I will provide revenue and earnings guidance for Q3, and then we would be happy to take some questions.

Revenue for Q2 was $126.4 million, and adjusted EPS was $0.17 per diluted share. Our Q2 results show positive trends in our performance, and our employees should be proud of these results. We continue to focus on a list of internal initiatives to enhance the overall efficiency of the business. Notably, during Q2, we made progress in our inventory management processes.

And the net result was an improvement in inventory turns and a reduction in total inventory levels. While we still have a significant amount of work ahead of us, the operations team is doing an excellent job with this and other continuous improvement projects. Before moving to the details of our Q2 results, I would like to provide an overview of the impact of the COVID-19 pandemic on our business. As you know, MACOM is a global company, and we have employees across Asia, Europe and North America.

Since beginning of this pandemic, our top priorities have been to maintain the health, safety and well-being of our employees, keeping our business operational and delivering on commitments to our customers. Among other things, MACOM manufactures certain essential products for U.S. defense and telecommunications infrastructure applications. Accordingly, our U.S.-based manufacturing facilities have remained operational.

In addition to following local regulations and guidance, in order to maintain a safe work environment, we practice social distancing protocols, provide enhanced employee screening, restrict on-site visitors and nonessential staff, and conduct enhanced facility cleaning and disinfecting procedures regularly. We’ve also implemented a work-from-home posture for our employees in nonmanufacturing functions, including customer service, engineering and administration. At the same time, our global sales force has remained actively engaged with customers using video and teleconferencing. Our operations team has been working with our global suppliers to mitigate the impact of COVID-19-related interruptions to our business.

During the quarter, we experienced both supplier closures and partial shutdowns specifically from certain Asia-based suppliers, including assembly and test subcontractors in Malaysia. We have managed these issues effectively, and we do not believe these interruptions have had a material impact on our business to date. However, the situation is dynamic, and it requires daily management by our operations team to support our customers. But simply put, our dedicated employees have rallied to keep our business and operations up and running in an effort to service our customers and meet our commitments.

Our Q2 revenue by end market was as follows. Data center was $26.7 million. Telecom was $51.6 million, and industrial and defense was $48.1 million. Data center and telecom had sequential growth rates of 16% and 13%, respectively.

Industrial and defense was down 5% sequentially. On a geographic basis, 45% of second-quarter revenue was from domestic customers, and 55% from international customers, similar to prior quarters. Our book-to-bill ratio was approximately 1.25 to one. And our turns business or business booked and shipped within the quarter was approximately 22% of total revenue.

Generally speaking, demand for our products was strong in the second quarter. We experienced strong bookings across all three of our end markets, and we are pleased with the growth of our backlog. I’ll highlight that we have very little consumer electronics or automotive business exposure. We are staying in close contact with our largest customers in closely monitoring channel inventory, general order activity and long-term demand forecasts.

We believe the strong Q2 bookings is due to a combination of improved data center and telecom end market demand, market share gains and, to a lesser degree, from customers ordering ahead of end demand due to fear of future component shortages caused by COVID-19 supply chain disruptions. For Q2, sequential growth in our data center end market revenue was driven by cloud data center demands. Our 100G high-performance analog products and our emerging 200G and 400G analog product lines support this market segment. We view ongoing demand for data bandwidth and associated infrastructure upgrades inside the data center to be a strong growth driver for MACOM in the years ahead, and we see the emergence of 200G and 400G to be opportunities to expand our position in the market.

Sequential growth in our telecom end market revenue was primarily driven by demand for 5G products, as well as from new products such as our 64-gigabaud metro/long-haul product lines. As a reminder, we have a broad portfolio of 5G products today consisting of receive side RF front-end modules, control products for base stations, high-performance analog ICs for 5G fronthaul and high-performance coherent driver and TIA products for mid-haul. We view 5G infrastructure deployments as a key growth driver for MACOM revenue in the years ahead. And in the coming quarters, we anticipate expanding our current 5G portfolio by launching complementary new products, including additional optical components, more discrete RF components and more high-performance analog and mixed-signal ICs.

Our industrial and defense end market revenue continues to be driven by long-term U.S. defense programs, particularly in electronic warfare applications, along with satellite communication applications and increased sales to test and measurement customers. Ultimately, we believe that revenue growth in our three end markets will be driven by our ability to design and bring new products to market quickly and win market share. We are confident that the changes made in our engineering management and broader organization last year, as well as the updates to our product development process will enable us to improve MACOM’s competitiveness and time to market.

Before discussing our notable new product releases for the second quarter, I would like to highlight that in lieu of attending OFC, we hosted virtual product demonstrations. In total, we hosted over 30 demonstrations and interactive private video meetings with customers. We’ve had three engineering test events showcasing MACOM products in real-world optical applications. We believe these demonstrations were well received and served to further educate our customers, and we expect these efforts will ultimately lead to new design wins.

We had three demos. First, we showed a complete chipset for 50G PAM4 transmit and receive links with Ethernet security for 5G mid-haul deployments over 10 kilometers. This chipset featured a total of five MACOM ICs, including our PRISM-50 DSP, silicon photonics IC, a 26-gigabyte TIA, high-speed photodetector and a MACSec Phy SoC. Second, we showed a high-speed analog chipset to support 200G modules for use inside the data center that is compliant with the Open Eye MSA standard.

Our demo included customers 200G and 400G QSFP modules and active optical cables built upon the MACOM chipset. These analog modules were plugged into commercial Ethernet switches running live traffic and we’re successfully working with other DSP-based optical modules. And third, we showcased 100G single-lambda DR/FR PAM4 link over two kilometers of fiber, leveraging MACOM’s latest PRISM DSP, 56-gigabaud TIA and high-speed photodiode. This setup is ideal for point-to-point or 4/100G breakout applications inside the data center.

Our lightwave engineering teams released a number of new products during the second quarter, including a 25G Avalanche Photodiode or APD. APDs are key optical components in 5G wireless and data center applications. Our 25G APD is capable of operating between 1,250 and 1,650 nanometers and features very high sensitivity of minus 22 dBm when coupled to a low noise amplifier. MACOM will offer the 25G APD as a bare die and in chip-on-carrier formats to provide maximum design flexibility to our customers.

As a reminder, our lightwave engineering team designs best-in-class APD devices, as well as a portfolio of over 15 unique laser configurations. Our laser technology is targeting applications in the data center, telecom infrastructure, as well as industrial and defense markets. We approach customers with a strong knowledge and experience in high-speed data transmission, optical transmission, lightwave detection and communication systems with a goal to win semiconductor component business. We seek applications in all markets where customers transmit and receive high-speed digital signals using optical technology.

During Q2, our high-performance analog team extended our transimpedance amplifier or TIA portfolio with two new TIAs optimized for use in applications ranging from 100G DR1 to 800G DR8 and FR8. The first new TIA supports high-throughput optical data links in a very low-power profile optimal for use in high-density optical data center interconnects. The device is intended for 50G to 400G receivers using PAM4 modulation. The second new TIA is a quad 26/53 gigabaud linear PAM4 TIA with automatic gain and integrated AGC loop.

The TIA consumes very low power and is primarily targeted for single-mode fiber applications. These new TIAs are available to customers in flip chip and wire bonding packages options for flexible deployment. Our RF and microwave engineering teams continue to expand their product lines with the goal of gaining further market share in our core industrial and defense markets. We are focused on executing our product plans more efficiently while also challenging our designers and technologists to raise the level of innovation with more best-in-class products.

We believe that our MMIC and diode product lines are getting stronger, and we will continue to expand with differentiated performance. The products I’ve just highlighted and our other recently introduced products provide us the opportunity to gain market share and drive revenue and profit growth in the near to midterm. At the same time, we continue to work on long-term R&D, which will support our next-generation products in MACOM’s long-term growth. Given the uncertainty in the markets, I would like to highlight to investors that MACOM is a strong company that has a deep and diverse technology portfolio, and we service three very large end markets.

We have thousands of customers and dozens of product lines. Some of our product lines have extraordinarily long life cycles and they produce revenue years after they’ve been introduced. Our R&D team continues to complement this strong foundation with new products and technologies, some of which I’ve discussed today. We are fortunate to have limited customer concentration, limited to no consumer electronics and automotive business exposure and limited product revenue concentration.

We believe that these business attributes, along with our improved execution and financial performance will support new successes and new market share gains. We maintain a long-term view on our business. And while COVID-19 may disrupt or impact us in the coming months or quarters, we believe it will not change our fundamental long-term growth opportunity as our business is small relative to the large end markets we serve. That said, we are planning for both best and worst-case scenarios given the risks and uncertainty associated with the COVID-19 pandemic.

Jack will now provide a more detailed review of our Q2 financial results.

Jack Kober — Chief Financial Officer

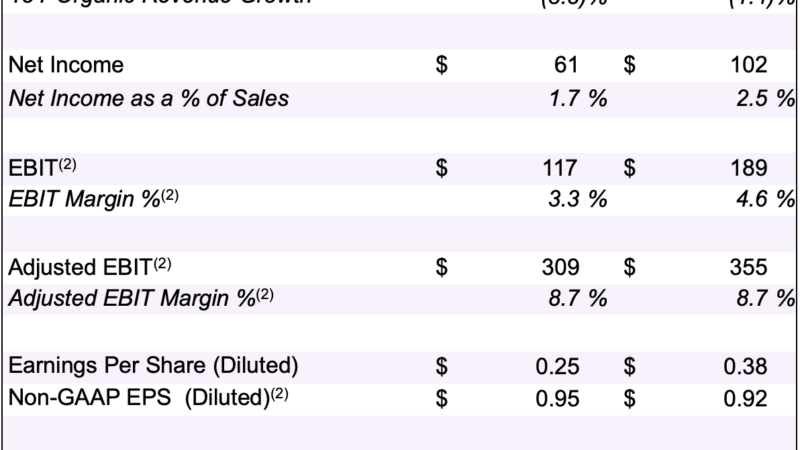

Thanks, Steve, and good afternoon, everyone. Our fiscal Q2 results demonstrate the continued improvement in the overall profitability and cash flow of the company. We posted sequential improvements in revenue, margins and adjusted earnings per share. We also reported another quarter of positive cash flow, exiting Q2 with our highest combined cash and short-term investment balances since the third fiscal quarter of 2017.

I would like to thank all MACOM employees for their dedication not only in keeping our business operations functioning during this COVID-19 pandemic but also supporting the growth in orders and revenue, as well as helping to manage our spending. Revenue in the second fiscal quarter of 2020 was $126.4 million, up 6% sequentially. The sequential improvement was driven by positive trends in our telecom and data center markets, including growth from early 5G deployments and strong demand in data center upgrades. Overall, industrial and defense demand remains healthy despite our anticipated modest sequential revenue decline.

On a year-over-year basis, revenue was down 2% from $128.5 million in the second fiscal quarter of 2019. Adjusted gross profit in Q2 was $68.9 million or 54.5% of revenue. Adjusted gross margin was up 100 basis points sequentially. As we’ve discussed in the past, gross margin improvement remains a corporate priority for us.

The team has done an excellent job of maintaining focus on our internal margin improvement initiatives in spite of the COVID-19 pandemic-related operational challenges we faced during Q2. We believe these initiatives, which target cycle time improvement, scrap reduction and other operational efficiencies, will continue to result in incremental gains in gross margin over the course of fiscal 2020 and beyond. Total adjusted operating expense was $49.3 million, consisting of R&D expense of $31 million and SG&A expense of $18.3 million. Operating expenses were down $1.4 million sequentially.

We will continue to balance investments in new product opportunities while diligently managing our discretionary spending. Adjusted operating income in the second quarter was $19.6 million, up $13 million in fiscal Q1, translating into 15.5% adjusted operating margin. We expect the combination of improving gross profits and stable operating expenses will provide continued operating leverage throughout the remainder of the fiscal year. Depreciation expense for Q2 was $7.3 million, and adjusted EBITDA was $26.9 million.

Fiscal Q2 adjusted net interest expense was approximately $6.7 million, down around $900,000 from the first fiscal quarter of 2020. The decline was primarily driven by declining interest rates on our term loan. Looking ahead to fiscal Q3, we expect to see an incremental reduction of approximately $500,000 in net interest expense, primarily from the full-quarter benefit of lower interest rates. Our non-GAAP adjusted income tax rate in fiscal Q2 continued at 8% and resulted in an expense of approximately $1 million.

We expect our non-GAAP adjusted income tax rate to remain at 8% for the remainder of this fiscal year. Fiscal Q2 adjusted net income was $11.9 million, compared to $4.9 million in fiscal Q1. Adjusted earnings per fully diluted share was $0.17 in fiscal Q2, utilizing a share count of 68.1 million fully diluted shares compared to $0.07 of adjusted earnings per share in fiscal Q1. Now moving on to cash flow and balance sheet items.

Cash flow from operations came in at $25.3 million. Improvements in operating income and inventory management helped to enable strong cash generation for the quarter. Capex totaled $4.8 million or 4% of revenue. Despite the lower capital spending, we continue to invest in priority programs.

We continue to remain focused on achieving appropriate returns on capital that we deploy, and we expect overall capital expenditures in fiscal 2020 to be well below our fiscal 2019 levels. Free cash flow was $20.5 million for the second fiscal quarter and $33.4 million in Q1. These fiscal 2020 improvements in cash flow are a result of revenue linearity improved operating income, reduced capex and other working capital improvements. We believe the numerous structural changes we have made throughout the organization will continue to drive positive cash flow as we progress through the second half of the fiscal year.

Accounts receivable was $53 million, up slightly from $52 million in Q1. Days sales outstanding were 38 days, down from 42 days in Q1. Inventories were just below $100 million at quarter-end, down approximately $7 million sequentially. Inventory turns improved 2.3 times during the second fiscal quarter.

As Steve had mentioned, inventory management remains an area of emphasis, and we see opportunities to continue to improve our inventory metrics going forward. Overall, working capital was $103 million in fiscal Q2, down approximately $2.5 million sequentially. Cash, cash equivalents and short-term investments were $221.5 million, up $11.5 million from fiscal Q1. As a reminder, our short-term investments are comprised of corporate bonds and commercial paper and are classified as held for sale.

Total long-term debt was $683 million, inclusive of finance leases. Our long-term debt of $654 million is covenant-light and has minimal annual principal repayment until its maturity in May 2024. We also have an undrawn $160 million credit line available through November 2021. It’s worth noting that our trailing 12-month EBITDA increased in Q2 for the first time since early fiscal 2019, nearly doubling sequentially.

We believe that this trend of improving EBITDA should help to improve the leverage ratio of the company over time. As we’ve discussed in the past, we remain confident in our liquidity position, and believe the structural improvements we have made to increase our profitability and cash flow will provide us with sufficient financial options to execute our strategic objectives. In summary, we feel Q2 was another quarter of solid financial performance, and we are pleased with our progress. We also understand there is still much more for us to do in order to achieve our longer-term objectives and believe that we will continue to build positive momentum across the business.

I will now turn the discussion back over to Steve.

Steve Daly — President and Chief Executive Officer

Thank you, Jack. MACOM expects revenue in Q3 ending July 3, 2020 to be in the range of $129 million to $133 million. Adjusted gross margin is expected to be in the range of 54% to 56%, and adjusted earnings per share is expected to be between $0.19 and $0.23 on based on 68.5 million fully diluted shares. Our Q3 revenue projections include expectations that our three end markets will grow sequentially.

Specifically, we believe our revenue growth will be driven by the increase in data center traffic, 5G network deployments and increased demand for our RF and microwave products and defense applications. We are excited about the multiple growth opportunities in front of us, and we are focused on execution and planning. I would now like to ask the operator to take any questions.

Questions & Answers:

Operator

Thank you. [Operator instructions] Our first question comes from Harsh Kumar with Piper Sandler. Your line is now open.

Harsh Kumar — Piper Sandler — Analyst

Yeah. Hey, guys. First of all, huge congratulations. There aren’t a whole lot of companies that are beating and then actually guiding up on a sequential basis, so a tremendous job.

I had two quick questions. First of all, Steve, you talked about strength in the June quarter, rising from the March time frame. And you said all three end markets would grow. I was curious if you could give us some color just for modeling purposes, whether one will outperform the other or where do you think you’ll get more traction based on your backlog.

Steve Daly — President and Chief Executive Officer

Thanks, Harsh. So we think that the data center will lead the growth going into the next quarter, probably a double-digit growth — strong double-digit growth. And then telecom and I&D, I would say, mid-single digits, plus or minus a little bit.

Harsh Kumar — Piper Sandler — Analyst

OK. And then for my follow-up, you guys have a bunch of strategic products in the pipeline, I believe, for the rest of the year. We’re hearing 10-gig PON is coming back in China in a strong way. I believe you guys were also working on PAM4 analog product.

And you might have referred to that in some of the demo information. I was curious if you could give us some idea of some of these critical products. Are they still on track despite COVID and all that’s going on here in the world?

Steve Daly — President and Chief Executive Officer

Sure. So I would say, generally speaking, our R&D team is doing a great job holding schedules and continuing to move ahead and make reasonable results given the current situation. I will say that there have been some minor delays in terms of getting product tested in the labs given the social distancing and whatnot that we’re practicing. But generally speaking, we’re on plan for where we want to be and where we want to go in terms of product development and product launches.

And I’ll just highlight maybe as an example, we are well ahead of last year’s total product introductions even given the COVID-19 pandemic situation. So the team is really stepping up and doing a great job. In terms of some of those strategic programs that you’ve talked about, you’re correct, we do have quite a few of them. Whether it be some of our silicon photonic work that we’re doing, some of our advanced laser work, some of our power amplifier process technology work that we’re doing, as well as challenging our analog designers to design analog solutions at higher data rates.

So there’s probably too much there to drill down on and to discuss in any level of detail, but I would say, generally speaking, we have a solid plan. We’re executing to the plan. We are not updating any pivots per se on any of those strategic programs that I think you’re referring to. So it’s really steady progress at this stage.

Operator

Thank you. Our next question comes from Quinn Bolton with Needham. Your line is now open.

Michelle Waller — Needham and Company — Analyst

Hi, guys. It’s Michelle on for Quinn. Congrats on the quarter. I just had one question.

In terms of — for 2Q, you mentioned that customers are pulling in inventory to prevent risk of future supply constraints. I’m just wondering, and maybe I missed this, but I assume you’re saying that it’s going into the third quarter, and I’m just wondering, is that more on telecom side or data center side or both? Or maybe you can give a little bit of color on which markets you’re seeing that.

Steve Daly — President and Chief Executive Officer

Yeah, that’s fine. And maybe I’ll just give some general background, and then Jack can quantify it for us. So I have to say that we’ve had some tremendous bookings over the past number of months. And so we actually believe the majority of this — the vast majority of this is end market demand-driven, and only a small fraction is actually sort of overreacting and sort of panic buying due to the COVID situation.

I would say that the strength in the bookings is coming from data center and telecom and then, to a lesser degree, I&D. I’ll also highlight that our channel inventory is very healthy right now. We’ve been monitoring our channel partners and distributors, and their inventories have been moving down over the past six months, really, by our design. And so we’re very pleased with the level of inventory in the channel.

We see very strong bookings, which we believe are end demand-driven. I will say we do see a bit of softness in Europe. If I were to call out any one territory or region that’s sort of softer than the others, it would certainly be across Europe. And Jack, I don’t know whether you want to quantify in terms of levels where we may think customers are buying a little bit ahead of demand.

Jack Kober — Chief Financial Officer

Yeah. So with regard to some of those types of orders, we don’t believe it’s significant. We do have active conversations with our customers to try and get an understanding of the ultimate end-use demand or whether they’re stocking these items. But if we were to quantify it, it’s probably less than 5%.

Michelle Waller — Needham and Company — Analyst

OK. That’s helpful. And if I can actually just sneak another one in there. Huawei, I know you guys said that they had significantly declined after being placed on the trade restriction entity list.

So just wondering, though, did you see any sort of increase in the second quarter from — off the first quarter or what the change, if any, at all, in Huawei orders?

Jack Kober — Chief Financial Officer

Yeah. Thanks, Michelle. So in terms of Huawei, they’ve been a less-than-10% customer for quite a few years now. As we’ve been stating in some of the prior discussions, their revenue has been declining for us over time, so really no meaningful change to that.

Operator

Thank you. Our next question comes from Tom O’Malley with Barclays Capital. Your line is now open.

Tom O’Malley — Barclays Investment Bank — Analyst

Hey, guys. Thanks for taking my question, and congratulations on the strong results. I just want to start out with the guidance. You obviously are taking some consideration of some COVID impact.

If you just take kind of the midpoint of what you described as double-digit growth in data center and then mid-double digits in telecom and industrial, you get a little bit above your range. Can you talk about where you’re being cautious and what areas you think you’re giving yourself a little bit of room to get back in the range that you’re guiding?

Steve Daly — President and Chief Executive Officer

Yeah. So I think our ops team is working very closely with our sales organization to make sure that we come up with the most accurate guidance that we can give. I wouldn’t necessarily want to carve out any one end market or customer or even product line. It’s really making sure that operations understands any associated risks with the forecast for the third quarter.

Now the good news is we have a very high backlog for the third quarter, and we’re already one month into the quarter, so we’re very comfortable with the supply chain risks that are sort of built into our guidance. And so we think we’re doing all the right things in terms of planning. I will say that generally speaking, the supply chain is recovering. So in areas where we’ve started maybe a month or two months ago, where we were seeing impacts and shutdowns, we are seeing our suppliers come back online.

That’s not only in Asia but also across Europe and here in the U.S. I will say, by the way, from a supply chain point of view, we effectively had no interruptions from our third-party wafer foundries. So the good news is we were able to receive the materials that we needed. Our fab remained completely operational.

So from a raw material point of view, we’re in a very good position to service not only the third quarter but also beyond. So I think our guidance is as accurate as we can make it given all these different moving parts.

Tom O’Malley — Barclays Investment Bank — Analyst

Great. And then just a quick follow-up. You mentioned that Huawei revenue was going up, but you’re also seeing sequential growth in telecom. Clearly, there’s a number of tenders that are coming out in China right now for optical builds.

Where are you seeing the sequential growth in telecom? Is that U.S.-based, or are you participating in the Chinese ramps elsewhere outside of Huawei?

Steve Daly — President and Chief Executive Officer

Yeah. So I would say that it’s primarily 5G-driven, and the majority of that activity is China-based. And then as you drill down and look at the OEMs and their customers and their suppliers, we try to service as many as we can. I wouldn’t want to call out any one particular OEM in terms of our position as it relates to optical infrastructure.

I think the key point here is we are seeing more opportunities. The volumes are going up. We have very compelling technology for 5G fronthaul and mid-haul for analog solutions, laser solutions, detector solutions that I talked about. So we actually have a very strong product set for the 5G rollout on the optical side, which is what you’re referring to.

So I think it’s really more than just any one customer driving our demand. We see lots of demand from lots of customers.

Operator

Thank you. Our next question comes from Richard Shannon with Craig-Hallum. Your line is now open.

Richard Shannon — Craig-Hallum Capital Group — Analyst

Well, great. Thanks for taking my questions as well. Steve, in your prepared remarks, you talked about — finding my notes here, you talked about some market share gains. And I think you’re referring to both data center and telecom.

Can you give us more detail on where that’s coming from, which products in geographies or customers that that’s relevant to?

Steve Daly — President and Chief Executive Officer

Absolutely. So I would probably start with our diode products. So our team within our diode business unit has really been doing a very nice job, picking up business that previously we may have been losing. There is a renewed effort to drive growth in our industrial and defense end markets, which means taking our existing technologies, repackaging, repricing.

In some instances, screening. So that is certainly an area where I see market share gains. Typically, our competitors in this technology area are weaker than us. So it’s our goal to continue to put pressure on these smaller and weaker competitors and win that business.

In terms of the other areas, I would probably also highlight our HPA or high-performance analog team is doing a very good job winning business, not only with 100G analog solutions and picking up new customers, but also going into adjacent markets. Part of our strategy will be to expand beyond the data center and beyond telecom with some of our high-performance analog design capability. And so we’re starting to see new opportunities and win business and go after business that maybe a year or two years ago we wouldn’t have gone after. And then the last thing I’ll add is I just want to emphasize that 5G architecture really plays to MACOM strengths with the very large optical piece of that network.

And this is an area where a year ago, two years ago, we had no business. So the fact that there’s a large optical component there is going to drive our growth in the months and quarters ahead. And that includes, by the way, not only the fronthaul piece but also the mid-haul piece.

Richard Shannon — Craig-Hallum Capital Group — Analyst

OK. Thanks for that, Steve. A follow-on question, I guess kind of following the end of your response here to the telecom market. You’ve talked about 5G mostly within that segment.

And I guess from your other comments, it would be a relatively small piece of the telecom from a dollar point of view. So how do we reconcile the rather small concentration or exposure there with your fairly strong growth both in March and June quarters here? Is 5G driving most of that, or is there also some benefit coming from PON and backhaul and other things like that?

Steve Daly — President and Chief Executive Officer

So I would say that there’s, this quarter and going into next quarter, less growth on the PON side, and it’s more on the 5G side. We did have actually some significant growth going from Q4 to Q1 this year. And now we’re seeing that growth continue. I think it was just two quarters ago or three quarters ago, the telecom market was below $40 million, and this quarter, we’re above $50 million.

So we like the growth. We like a steady business and the diverse type of business that the 5G market is bringing to us. I will highlight that there are areas of bright spots. Of course, there’s also areas where we need to do a lot of work, including on the RF boards within the 5G radios themselves.

It’s a very competitive market. Today, we support the market successfully with front-end modules and high-power switches. But we have a lot of work to do on the power amplifier side. So that’s an area where we are behind and we do need to do a lot of work there, and we recognize that.

And so we’re going to build that into our strategy as we move ahead.

Operator

Thank you. Our next question comes from Harlan Sur with JP Morgan. Your line is now open.

Harlan Sur — J.P. Morgan — Analyst

Good afternoon, guys, and great job on the quarterly execution, strong gross margin performance. If I look at the March quarter results and June quarter guidance, your incremental gross margins on the incremental revenue growth is falling through at about 70%. Historically, it’s been about 60% to 65%, so pretty strong step-up. Is that more a function of mix, or is that a combination of mix and the manufacturing efficiencies driving lower costs? And going forward, is this how we should think about the gross margin contribution on revenue growth?

Jack Kober — Chief Financial Officer

Yeah. This is Jack. So in terms of that step-up that we’re seeing going from Q2 to our Q3 guide, there’s a number of different elements that come into play there. Obviously, the increase on the top line helps in terms of the overall gross margin step-up that we’re showing here in the quarter.

There’s been a number of initiatives that we’ve been working throughout the company that are ultimately driving that sequential margin improvement that you’ve been seeing over the past couple of quarters. And this is the next natural step in our progression from a guidance range perspective. So I mean, it’s going to be kind of a step-by-step process as we continue to work through things and continue to execute along these initiatives that we have that are ultimately improving the margins. And mix is a big piece of how that can come into play in terms of the margin.

Harlan Sur — J.P. Morgan — Analyst

OK, great. Thanks for the insights there. And then on the product side, I know you mentioned some of this in the prepared remarks. But on the 5G sort of mid-haul, backhaul, depending on the distance, like we’re hearing customers using 100-gig, they’re using 200-gig PAM4.

Some cases, they’re using coherent. And then in data centers, you mentioned, you have customers making the early transition to 200- and 400-gig using 25 gigabaud, 56 gigabaud drivers in TIA and PAM4 DSP. These new PAM4 opportunities potentially pulls in your PAM4 DSP in addition to your TIA and drivers. Are you guys seeing the adoption of PAM4-based devices in 5G? And do you have design wins on both 200-gig 5G and 200-gig data center and also 400-gig for data center? And if so, like when would we expect to kind of see that be tangible to the revenue growth here?

Steve Daly — President and Chief Executive Officer

OK. So I’m going to try to address all of those points, but if I missed some, help me. When I think about fronthaul, I think about 25-gig links. When I think about mid-haul, I think about 50-gig links.

So that’s our starting point. So when we think about the products that we can support fronthaul, we’re specifically referring to clock and data recovery circuits, TIAs and drivers. We want to introduce 25G FP lasers, and that’s something that we talked about in the script. That’s something we’re demonstrating, and it’s a product line that we’re sampling customers.

When we think about 50G links now, different module form factors, we believe we have a product called PRISM-50, which is essentially a PAM4 DSP. It’s a cousin of our PRISM project that we’ve been working on. It’s in R&D. We don’t have any design wins, but it’s working quite nicely in this application.

And so we demonstrated that just a few months ago with our lead customers and lead prospects, let’s say, and we’re gaining interest and traction. On the mid-haul piece, I would also add that the TIAs are generally very high-end TIAs, and I would argue that MACOM today has the best TIA in the market. We are winning market share there as a result of that. The last item is the driver for mid-haul, and so that’s another area, again, new revenue and new interest on this product line.

So that’s a very concise review of fronthaul and mid-haul. When you go into the data — did you have a question on that?

Harlan Sur — J.P. Morgan — Analyst

No. You’re right. That was very concise. Thank you.

Steve Daly — President and Chief Executive Officer

And then I just wanted to — I think you mentioned the data center in 400G. And I can tell you that there’s parallels. So we are today supporting 400G and 200G applications with our TIAs, as well as our 56 gigabaud drivers, OK? And so those would be supporting 200 and 400. And just if you think about the different reaches, those go all the way from short reach or SR, all the way up to long reach, LR.

And so that revenue today is small. These are relatively new products, just gaining traction. Those products are not what’s driving the growth today, but they will, if we go out in time, OK, if we’re successful. So I hope I’ve answered your questions, but I do think that you’re asking the right question.

And I think all of these products that we’re talking about are relatively new, and I think MACOM is a leader in this area.

Harlan Sur — J.P. Morgan — Analyst

Yeah. No. Thank you very much for the insights there. Just one more question if I may.

So on the industrial and defense business, as you improve the portfolio, I think much of your portfolio includes catalog products. So is the new development pipeline focused on multi-purpose diodes, multi-purpose high-performance analog and MMIC products to kind of continue to build out the catalog business? Or are you targeting more application-specific products for the various subsegments within I&D?

Steve Daly — President and Chief Executive Officer

So it’s a little bit of both, and it’s resource-dependent, opportunity-dependent, and we want to be — so we want to have our own product plan, where we want to raise the bar in terms of performance in the market. So that’s an internal plan. And we always supplement those activities with custom design work, whether it’s a diode, a MMIC. We want to be very friendly to our A&D customers, and we embrace that work.

And again, I think this is a change of strategy. We want to do custom MMIC design work for all the major U.S. defense OEMs. And we’re going to make sure that MACOM is at the table, looking at the latest specs and bidding very aggressively to win that business because this is right in our wheelhouse.

This is what we do very, very well. And I&D is, as you know, our largest-revenue segment, but it’s also the largest end market, so tremendous opportunities there.

Operator

Thank you. Our next question comes from Tore Svanberg with Stifel. Your line is now open.

Tore Svanberg — Stifel Financial Corp. — Analyst

Yes. Thank you, Steve and Jack, and congratulations on this tremendous turnaround. First question, and maybe this is a bit counterintuitive, but obviously, there’s a lot of questions about inventory build in the midst of the downturn. But as you talk to your customers, could we actually be seeing something completely different? Meaning, if you think about data center, 5G, are customers actually maybe pulling in some of those deployments, maybe even accelerating them somewhat?

Steve Daly — President and Chief Executive Officer

It’s very possible, Tore. And this is a question we’re asking, as well as we look at the strong bookings. And so as Jack alluded to in some of his comments, when we see large orders coming in, we do a lot of investigative work to understand what’s behind this. Are customers placing orders because they have won new business, or are they getting ahead of expected future business? And so I think that it’s a hard question to answer, but I think it is possible, yes.

Tore Svanberg — Stifel Financial Corp. — Analyst

Very good. And maybe my perception is wrong here, but I think you mentioned some new products for test and measurement. Could that be kind of like the fourth leg on the stool here? And if not, is it still going to be embedded in any of the three categories?

Steve Daly — President and Chief Executive Officer

It’s an interesting question also. So I would say that our typical business in industrial and defense and specifically test and measurement, which is a submarket in that category, the order sizes are generally smaller than, say, some of the large, high-volume sockets that we’ve been talking about over the past few minutes. So I would say that this is building out the base, and it’s something that will be done over time as opposed to, let’s say, a fast ramp, OK? So this is — we look at our industrial and defense business, and if you go back two years, it’s been flat, and we recognize that as a problem. And so the fix will be to design more products for the lead defense OEMs, screen products, repackaged products and do a better job going after the accounts from a sales point of view.

And so there is a big opportunity there. Moving the needle and the I&D end market, it’s a slow process. So I would temper expectations in terms of high growth in this area.

Operator

Thank you. Our next question comes from Tom Diffely with D.A. Davidson. Your line is now open.

Tom Diffely — D.A. Davidson — Analyst

Yes. Good afternoon. Kind of following on the — I was hoping to get a little bit of your thoughts on exposure and the outlook for specifically the industrial markets. You mentioned you didn’t have much auto exposure.

I’m curious on the other industrial markets what the exposure is.

Steve Daly — President and Chief Executive Officer

I would say that this is one market that we are most concerned about. We have a lot of customers across Europe that are in the industrial sector, and so we have seen a slowdown in bookings and whatnot. I think over the past two to three quarters, it’s been relatively stable, but we are seeing a weakness, not only over the past month, but maybe the last two months, things have started to slow down. So the markets that would be in that area would be, for example, folks that are building test instrumentation, people that are building even medical equipments, for example.

We provide essentially very unique products for MRIs, and we’re seeing a bit of a slowdown there. So the good news is there’s lots of customers, but the business level at any one customer is at a relatively low level, so we’re not too concerned about it. And as I highlighted in my remarks, we have no automotive or consumer electronic exposure, and those are the parts of the semi industry that have been hit the hardest with coronavirus.

Tom Diffely — D.A. Davidson — Analyst

Yes. OK. I appreciate that. And then just a quick modeling question.

We’ve been using an 8% tax rate. Does that change over time if data center or some of these other segments become a bigger piece of the pie?

Steve Daly — President and Chief Executive Officer

At this stage, Tom, 8% is where we’re looking for the remainder of the year from a tax rate — from non-GAAP tax rate perspective.

Operator

Thank you. Our next question comes from Tim Savageaux with Northland Capital Markets. Your line is now open.

Steve Daly — President and Chief Executive Officer

Hi, Tim.

Tim Savageaux — Northland Capital Markets — Analyst

Hi. Good afternoon. Sorry, about that, and I’ll add my congrats. A question back on the telecom side.

You were looking for high single-digit growth, I guess, mid to high. For Q2, you ended up around 13%, and I wonder if you could talk about what surprised you to the upside there. I know you’ve mentioned 5G fronthaul, mid-haul as a driver. You were seeing strength there previously.

So if you look at fiscal Q2, in particular, looking across your 5G-related markets, maybe just channel optical transport or PON, can you talk about where the upside was in the quarter? And I have a follow-up.

Steve Daly — President and Chief Executive Officer

Yeah. So I’m not sure I would say that we were surprised by the results for Q2 in any of our markets. They behaved fairly in line with what we were signaling on our last call, where, in fact, we had signaled that I&D was down this quarter, which it was. So in terms of the areas where we saw strength, again, it was the fronthaul market, which is 25G modules essentially.

And I would also sort of maybe add on top of that, we had some strong business with some of our metro long-haul products. So that’s sort of similar end application, right? So I would probably call out those two items as the ones that really drove the upside.

Tim Savageaux — Northland Capital Markets — Analyst

Great. And to follow up on that, you mentioned a couple of quarters ago, you’re under $40 million in telecom, now you’ll be at least with your guidance, maybe into the — close to the mid-50s. If you look at that kind of growth over that time period, I wonder if you can kind of segment it along the same lines in terms of end market or application driver. Should we assume that the bulk of that, the majority is 5G fronthaul and mid-haul-driven? Or are there any — or should we look at it basically is the same way you just described the upside drivers for Q2? Is there anything else going on there if you look over that longer time period?

Steve Daly — President and Chief Executive Officer

Yeah. So the telecom category is actually a large category for us, so it includes more than just 5G. It includes access, a whole variety of wireless and applications. So it would be a fair amount of work to kind of go down that list of sort of takes and puts.

It includes VoIP as well, which has been a legacy business that we’ve had, so I wouldn’t necessarily want to call out any one of the submarkets. I will say that some of our most exciting technology that we’re developing, including the laser technology, the analog solutions, the power products including power switches and power amplifiers for this end market, are compelling products. And so we’re pleased with the growth. We recognize we have a lot of work to do.

We recognize that we’re still below some of the prior-year peaks in this area, especially when 2.5G PON was running. So we recognize we have a lot of work to do in this area.

Tim Savageaux — Northland Capital Markets — Analyst

Thanks very much.

Operator

Thank you. Our next question comes from Mark Lipacis with Jefferies. Your line is now open.

Mark Lipacis — Jefferies — Analyst

Hi. Thanks for taking my question. The Department of Commerce introduced some new export control actions. Looks like it’s targeted at the military area to prevent acquisition of technologies under civilian use pretenses for military end uses.

I’m wondering if you guys had a chance to look at that yet and if you had any view of that if that might impact you. And then separately and related, given all the focus on China, can you give us a sense of what percent of your products are actually consumed in China? Thank you.

Steve Daly — President and Chief Executive Officer

Sure. So we are aware of the new BIS announcement that came out, I think, on Tuesday. Jack and I have both been briefed by our internal counsel, as well as our trade compliance folks to understand the details of that. Our initial assessment is that it really won’t impact our business.

A lot of the categories and the additional restrictions that are being put into place at first review don’t look like they’re going to impact us. But we are aware of that, and to the extent that we need to make adjustments to any of our procedures or policies, we’ll certainly do that. In terms of our exposure to China, I think our last output on that number was…

Jack Kober — Chief Financial Officer

It’s running in the low 30% range from a ship-to perspective.

Steve Daly — President and Chief Executive Officer

So low 30s.

Mark Lipacis — Jefferies — Analyst

That’s ship-to. And do you have a sense of what the consumption is by any chance?

Jack Kober — Chief Financial Officer

Unfortunately, at this stage, it’s a tough one to figure out in terms of what’s being consumed internally there versus reexported.

Mark Lipacis — Jefferies — Analyst

Got you.

Operator

Thank you. Our next question comes from C.J. Muse with Evercore. Your line is now open.

C.J. Muse — Evercore ISI — Analyst

Yeah. Good afternoon. Thanks for squeezing me in. You talked earlier on the call about winning share in TIAs.

And curious, how big of a market do you think that is? Can you share with us how accretive that is to margins? And then I guess interestingly, does the market share shift there enable you to bundle other components? And do you get to kind of double the win because of it?

Steve Daly — President and Chief Executive Officer

So probably, it’d be difficult for me to explain the margin — answer the margin question. We don’t typically breakout gross margins by product line. And today, it’s a small piece of our revenue, so it’s really not accretive at this stage. In terms of the bundling piece, we want to provide the customer value on a part-by-part basis.

And oftentimes, when you bundle two parts and force a customer to buy something they really not want to buy, you get a blowback effect. Our go-to-market strategy is to put the best products out there that we can, have a very compelling price. And whether they buy our TIA or our laser diode or our CDR, we want to provide a very professional approach to make sure that they pick the parts they want and they’re not penalized if they don’t buy all of it, let’s say. So we really don’t practice the bundling the way you’ve sort of described.

In terms of the size of the market, I’m sure if I gave you a number, it would probably be incorrect, so I want to shy away from that.

C.J. Muse — Evercore ISI — Analyst

OK. That’s helpful. And if I could just follow up. In terms of kind of this new world with COVID, and hopefully, it doesn’t last that long, but how are you thinking about cash that you want to have on hand today? And therefore, how do we think about the pay down of debt as your cash level exceeds that, perhaps, new level? Thank you.

Steve Daly — President and Chief Executive Officer

Great question. Jack, do you want to maybe start with that?

Jack Kober — Chief Financial Officer

Yes. So C.J., obviously, we’ve done quite a bit of modeling going back over to the summer of 2019 time period. And there’s a fair amount of modeling that we’ve put together some upside, some downside as we work our way through it. So to some extent, we’ve had a head start on the modeling aspects and what a potential downturn might look like and how that might impact us.

But where we stand today, we’re fairly confident in our liquidity position and the cash balances that we have, so we’re looking to keep our heads down and keep moving forward. We feel like the additional improvements we’ve made in the profitability and the cash flow generation will provide us with quite a few options as we go forward from a liquidity standpoint.

Steve Daly — President and Chief Executive Officer

Yeah, and I’ll just add to that. It’s kind of interesting. If you look back over the past period of times, we just delivered the lowest opex in 14 quarters. We delivered better gross margins for all of our fiscal ’18 and ’19, so the team has done a great job there.

And our operating income as a percentage of total revenue is, I think, better than what we’ve done over the past 10 quarters. So it’s really, as Jack said, doing the things that we’re doing to prepare for uncertainty and to build a strong business regardless of COVID or losing a main customer or a main market or having a competitor come in. We run a very diversified solid business that our goal is to make it a business that is very strong, and I think the employees of MACOM are doing a fantastic job to that end.

Operator

Thank you. This concludes our question-and-answer session. I would now like to turn the call back over to Steve Daly for closing remarks.

Steve Daly — President and Chief Executive Officer

Thank you. In closing, Jack and I would like to thank our employees for their extraordinary efforts and accomplishments during the past quarter. Thank you and good evening.

Operator

[Operator signoff]

Duration: 62 minutes

Call participants:

Steve Ferranti — Vice President of Investor Relations

Steve Daly — President and Chief Executive Officer

Jack Kober — Chief Financial Officer

Harsh Kumar — Piper Sandler — Analyst

Michelle Waller — Needham and Company — Analyst

Tom O’Malley — Barclays Investment Bank — Analyst

Tom OMalley — Barclays Investment Bank — Analyst

Richard Shannon — Craig-Hallum Capital Group — Analyst

Harlan Sur — J.P. Morgan — Analyst

Tore Svanberg — Stifel Financial Corp. — Analyst

Tom Diffely — D.A. Davidson — Analyst

Tim Savageaux — Northland Capital Markets — Analyst

Mark Lipacis — Jefferies — Analyst

C.J. Muse — Evercore ISI — Analyst