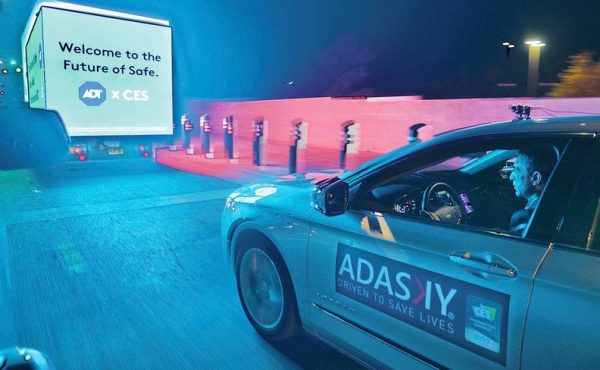

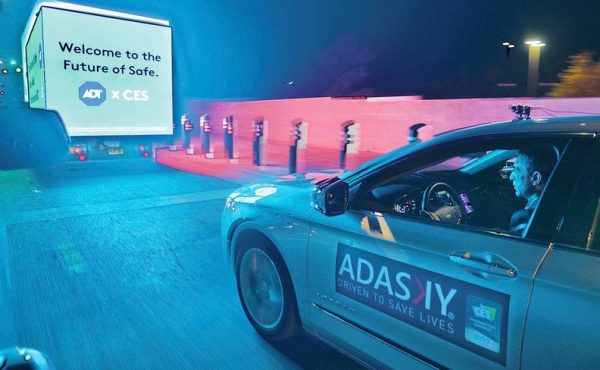

Sitting in a parked car along a quiet street, it was nearly impossible to see more than 60 or so feet into a dark Las Vegas night. A thermal-imaging camera mounted on the vehicle provided a more illuminating view.

Just beyond the range of the naked eye, a pedestrian teetered on the side of the curb. A block ahead, a homeowner wheeled a trash can toward the curb. Four miles east, cranes swung around the roof of a building under construction. Whether objects were mere feet or miles away, the resolution of the images displayed on the screen was incredible.

The demonstration offered a sneak peek of the precision that thermal-imaging cameras might soon bring to driver-assist and autonomous-driving systems. Perhaps as importantly, it served as one example of many at CES that showcased Israel’s increasing role in developing automotive technology.

Cohen: Helps Israeli startups

Mobileye, the auto-tech company acquired in 2017 by Intel for $15.3 billion, blazed the path. Across autonomous driving, cybersecurity and artificial intelligence, Israeli companies large and small have captured the attention of the global auto industry. But their collective importance was never more apparent than at CES this month.

The annual gadget-and-tech show attracted its highest levels of Israeli participation yet. Seventy-four Israeli companies participated, according to the Consumer Technology Association, which runs the event. Two years ago, there were 51 Israeli companies exhibiting at the show.

“Israel has never really manufactured any vehicle, and yet we have become the world leader in offering electronics and future technologies,” said Raz Peleg, head of sales at AdaSky, the startup behind the thermal-imaging technology. “You can think of cybersecurity, mass mobility, sensing, computing, picture analytics. They’re all startups that came up from a younger generation eager to have global success.”

Those younger startups are gaining traction. Relationships between the companies and traditional automakers have been forged as companies such as General Motors and Ford have established r&d centers in Israel. Now efforts such as these are paying off.

Showing promise

“The ecosystem has been maturing,” said Olaf Sakkers, a partner at Maniv Mobility, an Israeli venture-capital firm focused on next-generation mobility companies.

“A lot of companies have been developing technology for a while, and now they’re getting to the point where they’re starting to get integrated into the carmakers and forming partnerships with suppliers, a lot of which you’re hearing about at CES.”

Cartica’s system of using AI to facilitate active safety outlines cars and pedestrians in different colors in a demo drive at CES.

Among the promising startups is Cartica AI, a spin-out from an Israeli artificial-intelligence company. It says it has pioneered a self-learning technology that dramatically lowers the amount of information needed to train self-driving systems and the power needed to run them.

“I went to Tel Aviv for a day, and I was blown away,” said ex-Opel CEO Karl-Thomas Neumann, who invested his own money in the company, along with Toyota AI Ventures and BMW i Ventures, venture-capital arms of the respective automakers.

AdaSky’s thermal cameras could be a powerful addition to traditional sensors, helping to improve the effectiveness of driver-assist systems while reducing the number of rare situations encountered by self-driving vehicles. The cameras can see through poor weather and blinding light, two conditions that typically render regular cameras ineffective.

Sahar: Company showed the ease of a potential vehicle hack from afar

Elsewhere at CES, startup Foretellix showcased software that might help autonomous-vehicle developers test thousands of permutations of various driving scenarios rather than log thousands of real-world driving miles. Data marketplace company Otonomo announced Mitsubishi Motors Corp. would use its platform to provide in-vehicle services.

Upstream Security, an automotive cybersecurity company based in Herzliya, Israel, highlighted the ongoing car-hacking threat on paper and in practice at CES. The company released its “Global Automotive Cybersecurity Report 2020,” detailing the rise of malicious infiltrations in vehicles, noting a sevenfold increase in such incidents since 2016.

From Las Vegas, the company’s executives demonstrated the ease with which a hacker could commandeer a vehicle from afar, watching as an enlisted expert in Boston sent false commands to a car operating on a closed course in Tel Aviv. He showed he could manipulate safety-critical systems such as steering and braking. He also showed how a nuisance hack — locking doors, for instance — could turn into a major debacle.

“Imagine what would happen if the doors to an entire fleet of delivery vehicles were locked the day before Christmas,” said Dan Sahar, Upstream’s vice president of product.

Tal Cohen, a founding partner in Drive, a business incubator in Tel Aviv, has worked with Upstream and about three dozen other Israeli startups to ready them for the marketplace. He helps match them with global companies such as Aptiv, Hertz, Volvo Group and Honda. To date, he says he’s worked with 40 startups, which have 30 ongoing commercial engagements.

Setting expectations

Part of his job, Cohen says, involves setting realistic expectations between startups and large corporations that don’t naturally know how to work together.

“Even with great technology, a lot of startups don’t succeed,” Cohen said.

“You have hundreds of failures from very bright people. With the automakers and suppliers, I tell them right from the start, ‘If you can’t envision a process and a path to production, then don’t get involved. Don’t collaborate.’ But once we do that, once we pave the road, then the startups can fall behind us.”