Four Trends Driving Retail Technology Today – Forbes

Investment in retail technologies is growing, making purchasing and discovery easier and cheaper

Getty

How we shop and what we buy is changing. Store closures of established department stores or the sudden successes of new direct to consumer brands often feature in the press, but less attention has been paid to what lies under the hood.

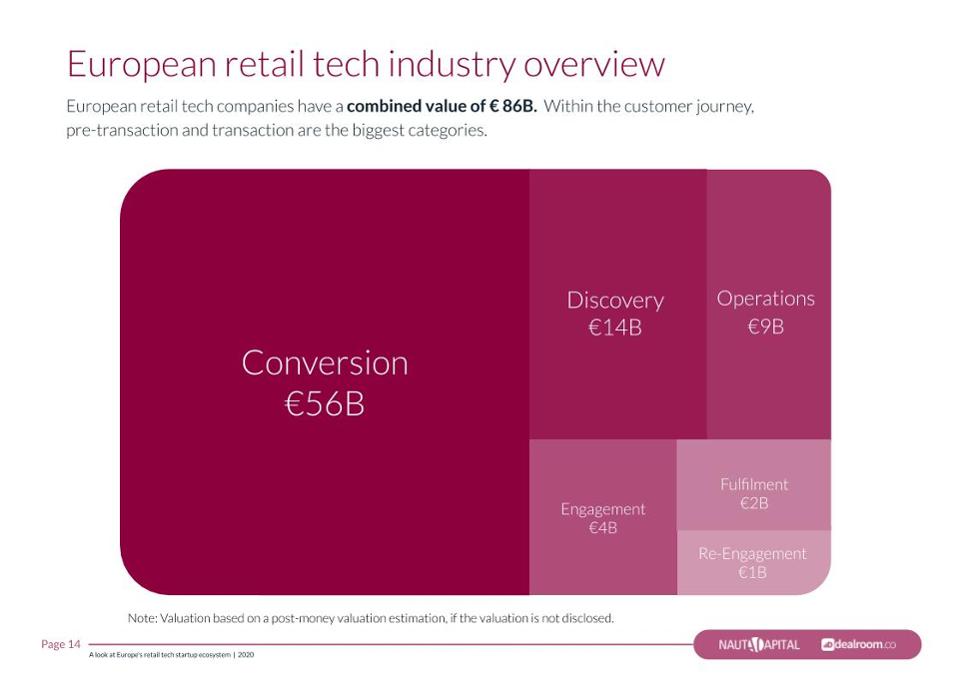

The technologies upholding the way we shop and what we buy are seeing unprecedented levels of investment, making retail technology a space full of creative destruction. According to a report by Nauta Capital, a European venture fund, and Dealroom, a deal tracking company, Europe’s retail technology companies have received over €7 billion in investment, and reached a combined valuation of almost €90 billion between 2015 and 2019.

However, retail tech is not an easy sector to succeed in. Not only do the entrepreneurs and investors in this space have to make great technology products, they also need to work with companies that are often slow to adapt to digitalisation.

Consumers remain a mystery

Speaking at the report’s launch event yesterday, venture investor Oksana Stowe, Head of True Seed Fund, said that finding a company that can deliver the single customer view, while staying within privacy regulations, is still the holy grail for many investors.

The more retailers and brands can understand why consumers make a purchase, abandon a cart or return an item, the more they can sell at the right price. According to McKinsey, a consulting firm, “those who invest in big data and advanced analytics often achieve up to 10% sales growth, up to 5% higher return on sales, and a margin uplift of 1 to 2%.”

However, Stowe also added that retailers already have a lot of data, but many are not using it effectively. For example, pricing and discounting decisions are often little more than guesses.

Investment flows where the money is

Technologies that improve conversion get the lion’s share of retail tech investment. Nauta’s managing partner Carles Ferrer attributed this to the fact that technologies that turn browsers into customers are closest to the consumer’s wallet.

The lion’s share of venture investment in retail tech goes into improving customer conversion

Nauta Capital, a pan-European VC, in partnership with Dealroom

This does not spell great news for companies focussed on product innovation and sustainability. The further the technology is from the point of sale, the harder fundraising for it seems to be at present. Yet, with sustainability being such a growing trend amongst consumers, more investment is surely likely to follow.

Frictionless retail

Continuing on the theme of the consumer’s wallet, many new and established companies are now aiming for frictionless retail. The aim of this is to make it as easy as possible to go from desire to possession.

Klarna, a Swedish fintech company, allows consumers to buy now pay later. With Mishipay, consumers can scan the items they want to buy in store with their phones, and then use their phones to pay.

In China, Alibaba trialled the no-checkout store, where QR codes and image recognition technology were used to identify consumers. To leave the store customers had to go through a payment door, which scanned the customer’s items and charged their account.

This is not just a kind hearted focus on reducing lines at checkouts. Studies have shown that the further away the consumer is from handling cash, the more they spend.

For example, a study conducted by Drazen Prelec at the Massachusetts Institute of Technology showed that people were willing to pay more than double for the same item when using credit cards, rather than cash.

But is it all too much?

While engineers are busy writing code, their target customers might not be ready to use it.

“There is much more technology available than the companies are able to digest,” said Gianni Leone, equity partner and board member at iStarter, and former Group Chief Information Officer at Gucci.

No matter how great the technology is, if the customer is not yet ready to use it, there is no business case.

Many large brands and retailers do not have technology and digital skills as part of their DNA, and find it hard to attract the best digital talent. This culture and talent gap means that even if the tools and data are available, retailers might not be able to use it.

Retail tech is a growing sector, but for companies and investors to succeed in this space, good technology is not enough. Understanding consumers, patiently working with customers and keeping a strong commercial focus is what really matters.

Do you work in a retailer or brand that uses new technologies? Or are you an investor or an entrepreneur in the retail tech space? What trends are you seeing in the retail tech sector? Please tweet your thoughts to @sophiamatveeva