Amazon’s Sharing Of Cutting-Edge Technology May Change The Way You Shop For Groceries – Forbes

Amazon’s first large retail grocery location that uses the Just Walk Out technology. (Photo by David … [+] Ryder/Getty Images)

Getty Images

Amazon Go will begin selling the Just Walk Out technology that fuels the 25 cashier-less convenience stores in the U.S. market. This move by the company falls in line with the diversified business strategy that has made Amazon more profitable. It will allow other companies that lack the resources to develop their own software the opportunity to use cutting-edge technology to improve the customer experience. The move will also broaden the brand image for Amazon and provide it with robust shopping behavior.

Just Walk Out technology

Amazon developed the Just Walk Out technology to support a truly seamless customer experience at the cashier-less Amazon Go stores. Shoppers can scan an app as they enter a store, pick merchandise off the shelves and leave the store without stopping to check-out. The receipt is sent to the customer after they leave the store.

Amazon Go Grocery, Seattle, Washington. (Photo by David Ryder/Getty Images)

Getty Images

Amazon has patented the Just Walk Out technology and is constantly improving the algorithms. Selling the technology to other companies will offset development costs for Amazon and provide added revenue to its business. Silicon Valley has shifted the mindset over the past decade from keeping newly developed technologies in-house to providing open access and collaboration with external partners.

Amazon is building on internal capabilities to drive profit

The company continues to invest in technology development and infrastructure to support business growth. In the case of the Just Walk Out technology, this is a triple win for Amazon since it will gain revenue from the grocery/convenience sector as more stores open, will have access to an increased volume of shopping behavior data and gain revenue from companies who license the technology. Furthermore, the licensing companies may be required to use Amazon Web Service (AWS) as the cloud storage with the Just Walk Out technology. Amazon’s strategy is to build out its internal capabilities across various platforms including technology advancements, data storage, logistics and cloud services.

Why this technology is significant

For over two decades the retail industry has had access to radio frequency identification (RFID) applications in the retail environment. RFID requires a tag to be placed on individual items so that beacons or other technologies can identify the items to collect various data. While vertically integrated companies have been able to use RFID to track inventory movement or understand design issues more quickly, most companies have not been able to implement wide uses of RFID due to cost. Andrew Lipsman, principal analyst, eMarketer agrees, “RFID is very expensive, especially in a business where there is a high inventory turnover of products which makes tagging items a high labor expense. The RFID implementation process is difficult and cumbersome.”

The technology used in Amazon Go environments supplants the need to tag every item and instead uses computer vision, sensor fusion and deep learning to track inventory in real-time through the shopper journey. The fluidity in the shopping experience delivers extreme convenience. Although it would make sense for Amazon to roll this out in Whole Foods, there was no commitment made by the company to do this in the near future. The company did state its plan to open 3,000 Amazon Go stores in the U.S.

The diversified business model

Companies such as LVMH, VF Corp and Amazon that are able to deliver preemptive distribution by staying ahead of today’s consumers are consistently achieving positive revenue gains and net income improvements through a diversified business model. Revenue for Amazon is derived from online stores, physical stores, third-party seller services, subscription services and AWS. Amazon accounted for 38.7% of total U.S. e-commerce revenue in 2019, however, there has been a shift of Amazon’s business model with AWS and third-party services. In the 2019 Amazon Annual Report, the online business represented 50% of total revenue as compared to 61% in 2017. AWS as a percentage of revenue has grown from 10% to 12% in the same period. Furthermore, AWS was the most profitable of Amazon’s businesses in terms of net income accounting for over 63% of the net income on 12% of the sales. Strategically, the company has stated in the annual report the growth in the AWS net income is based on increases in customer usage and cost structure productivity.

E-commerce drives other revenue streams

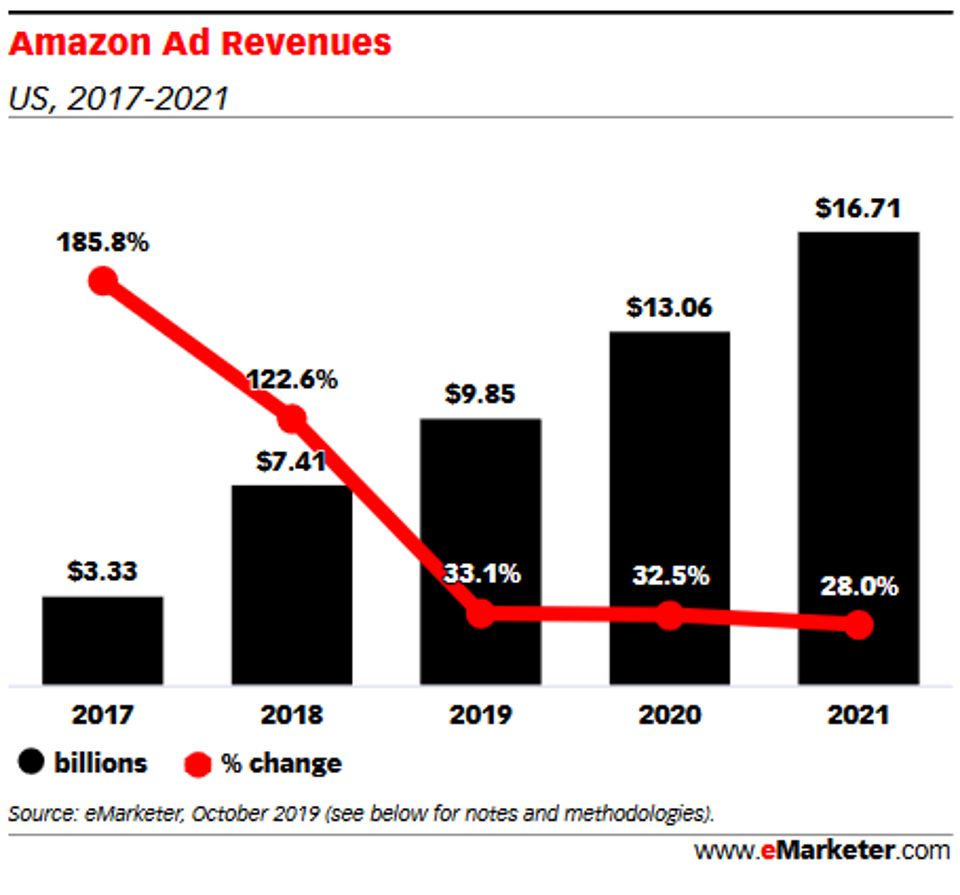

While AWS is highly profitable, the e-commerce business is a gateway for Amazon to drive revenue in other areas of the business. Lipsman states, “Amazon e-commerce sales grow other revenue channels. Advertising, for example, is an extremely profitable business for Amazon and as the digital sales grow so then does the advertising revenue.” Amazon’s advertising revenue has nearly quadrupled from 3.3 billion in 2017 to a projected 13.1 billion in 2020.

Amazon Ad Revenue

www.eMarketer.com

Who owns the data?

Since Amazon is collecting data through the technology and requires customer information to process the transaction, the question of data ownership (or data sharing) must be resolved when third-parties use the Just Walk Out technology. Lipsman believes, “Amazon Go’s Just Walk Out technology can provide Amazon a plethora of data insights about consumer shopping behavior in a market that has an extremely low 3% penetration of online sales. This will allow Amazon to become a significant player in terms of business intellect in the grocery/convenience store segment. There are smaller technology companies specializing in the expedited check-out process and these may be good options for competitors or other companies that may not want to share data with Amazon in a third-party agreement.” Over the next few years, the industry should become subject to more regulations including a set of practices being developed with regard to data ownership. Amazon did not respond to a request for comment.

The anticipated expansion in the use of the Just Walk Out technology will change how shoppers navigate convenience and grocery stores, but will also create a behavior change in shoppers who are new to this type of technology. Once shoppers come to appreciate the convenience of the technology, they will begin to expect it across additional store formats.