Micron Technology Inc (MU) Q1 2020 Earnings Call Transcript – Motley Fool

Image source: The Motley Fool.

Micron Technology Inc (NASDAQ:MU)

Q1 2020 Earnings Call

Dec 18, 2019,

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Operator

Thank you, ladies and gentlemen, and thank you for standing by. Welcome to Micron Technology’s First Quarter 2020 Financial Conference Call. [Operator Instructions]

I would now like to hand the conference over to your host, Head of Investor Relations, Farhan Ahmad. Sir, please go ahead.

Farhan Ahmad — Senior Director, Investor Relations

Thank you and welcome to Micron Technology’s First Fiscal Quarter 2020 financial conference call. On the call with me today are Sanjay Mehrotra, President and CEO and Dave Zinsner, Chief Financial Officer.

Today’s call will be approximately 60 minutes in length. This call, including the audio and slides, is also being webcast from our Investor Relations website at investors.micron.com. In addition, our website contains the earnings press release and the prepared remarks filed a short while ago.

Today’s discussion of financial results will be presented on a non-GAAP financial basis unless otherwise specified. A reconciliation of GAAP to non-GAAP financial measures may be found on our website, along with a convertible debt and capped call dilution table. As a reminder, a webcast replay will be available on our website later today.

We encourage you to monitor our website at micron.com throughout the quarter for the most current information on the company, including information on the various financial conferences that we will be attending. You can follow us on Twitter at MicronTech.

As a reminder, the matters we will be discussing today include forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from statements made today. We refer you to the documents we file with the SEC, specifically our most recent Form 10-K and 10-Q, for a discussion of risks that may affect our future results. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We are under no duty to update any of the forward-looking statements after today’s date to conform these statements to actual results.

I’ll now turn the call over to Sanjay.

Sanjay Mehrotra — President and Chief Executive Officer

Thank you. Farhan. Good afternoon. Micron is off to a solid start in our fiscal 2020. Despite a challenging industry environment, we delivered good profitability, maintained positive free cash flow, and strengthened our product portfolio.

Industry supply demand balance continues to improve in both DRAM and NAND. Recent trends in our business give us optimism that our fiscal second quarter will mark the bottom for our financial performance, which we expect to start improving in our fiscal third quarter, with continued recovery in the second half of

calendar 2020.

Our strategy to increase high-value solutions, enhance customer engagement, and improve our cost structure is producing results. We have materially improved our competitive position, structurally strengthened our profitability, and are poised to drive long term shareholder value as industry conditions improve.

High-value solutions in fiscal 2019 accounted for approximately 50% of NAND bits. We expect this figure to grow to over two-thirds of our NAND bits sold for fiscal 2020, and we remain on track to drive 80% of our NAND bits into high-value solutions in fiscal 2021. This mix improvement is an important tailwind for us as it improves our profitability and reduces the volatility in our margins.

At our Micron Insight event in October, we articulated a vision for Micron’s transformation through greater vertical integration and differentiated products for the new data economy. I will highlight two of these and encourage you to view Sumit Sadana’s Insight keynote, available on our website, for more detail.

First, we announced the acquisition of a small company called FWDNXT. The FWDNXT Deep Learning Accelerator, hardware and software technology, when combined with advanced Micron memory, makes it possible to deploy neural network models from any framework into edge devices for inference. FWDNXT’s unique technology is an important capability in our portfolio that will help us learn and better address customers’ needs in the evolving AI ecosystem.

At Insight, we also launched our first 3D XPoint product, the X100, which is the world’s fastest storage device. The Micron X100 SSD is dramatically faster than any other SSD, including those built with NAND or 3D XPoint technology, and we are proud that it was showcased at Microsoft’s Ignite conference by their Azure team.

In October, we closed our acquisition of Intel’s stake in the IMFT joint venture. We plan on relocating equipment and certain manufacturing employees to other Micron sites as we right-size the Lehi fab. Redeploying equipment will also help us optimize Micron’s front-end equipment capex. As with any

innovative technology, it will take time to scale up our 3D XPoint product portfolio, ramp revenues, and achieve healthy margins, and we are excited about the long-term potential of 3D XPoint for both memory and storage applications.

As the only company in the world with a portfolio of DRAM, NAND, and 3D XPoint technologies, we are in a unique position to develop differentiated products for our customers.

I will now turn to technology and manufacturing operations. In DRAM, our industry-leading 1Z LP4 DRAM-based uMCP had the fastest revenue ramp of any product in the history of our mobile business. Our production mix on 1Z will increase throughout 2020, and DRAM cost reductions will be skewed toward the second half of FY2020. Our previously announced cleanroom expansion in Taiwan is on track, and we expect output in calendar 2021. This cleanroom expansion is EUVcapable. While we continue to evaluate EUV technology for deployment in DRAM production, our current assessment shows superior economics through 1 gamma node utilizing advanced immersion technology along with Micron’s proprietary multi-patterning technologies. We are encouraged by recent industry progress on EUV productivity and will be prepared to deploy EUV when it becomes cost effective to do so.

In NAND, we are continuing to make progress on our replacement gate transition and expect to begin production on our 128-layer, first-generation RG node in the second half of fiscal 2020. As a reminder, this node will be deployed for a limited set of products, and we expect minimal NAND cost reduction in fiscal 2020. It will be followed by an introduction of a higher-layer-count, second-generation RG node in fiscal 2021 targeted for a broader implementation, which will begin to provide more robust cost reduction as it ramps. This second-generation RG node will leverage our NAND technology leadership in CMOS under the array, as well as QLC.

Now turning to highlights by products and markets. In SSDs, demand from data center customers was strong in fiscal first quarter. Attach rates and capacities for client and consumer SSDs have continued to increase across our customers. There are supply shortages for SSDs across the industry, and pricing trends are improving. We are making strong progress on our transition to NVMe. As of fiscal second quarter, we will have NVMe SSDs for all market segments, which positions us to gain share in fiscal 2020. NVMe client SSD bit shipments represented almost three-quarters of our client SSD bits in fiscal Q1, versus virtually none a year ago.

In the data center market, sales of our previously announced high-performance NVMe SSD nearly tripled quarter-over-quarter, and we announced a 96-layer mainstream data center NVMe SSD. While growing our presence in NVMe, we continue to maximize our value proposition for the SATA market by ramping 96-layer NAND products. We achieved qualifications with multiple OEMs on our 96-layer SATA data center SSD.

Our QLC technology continues to gain traction. We have QLC SSDs in volume production for SATA SSDs in the data center and consumer markets, as well as NVME SSDs for the consumer market. We became the first company to ship a 96-layer, second-generation QLC SATA consumer SSD.

In mobile, F1Q MCP DRAM and NAND bits grew approximately 50% quarter-over-quarter, and our MCP market share increased approximately 50% year-over-year. In fiscal Q1, our leading-edge 1Z LP4 DRAM-based uMCP achieved qualification at multiple OEMs, driving the fastest mobile product revenue ramp, I

mentioned earlier. We are confident that 5G will be positive for both memory and storage content growth, as well as smartphone unit sales, and are encouraged to see the launch of affordable 5G phones with price points as low as $300 that feature a minimum of 6 gigabyte of DRAM. The 5G phones launched to date average 8 gigabyte of DRAM and 200 gigabyte of NAND, significantly higher than the average content in smartphones today.

Our leadership on DRAM power efficiency continues to drive customer preference for our products, and we remain well positioned in this market. We have the lowest-power and highest-bandwidth LP5 product that begins volume production this quarter, which we expect will become more important in 2021 as 5G adoption accelerates.

In data center, strong server DRAM demand in the second half of calendar 2019 is creating an industrywide shortage of high-quality, high-density modules, for which we are seeing incremental demand from our customers. New CPU architectures supporting higher-density chips and increased number of channels are driving strong DRAM content growth in servers. In fiscal Q1, we saw strong demand growth from enterprise and cloud customers.

In graphics, bit shipments remained stable with GDDR6 PC graphics cards showing strong growth, offset by seasonal weakness in gaming consoles. In fiscal Q1, we began shipments of our new 14 gigabit per second GDDR6 and are well positioned to benefit from the launch of next-generation gaming consoles in calendar 2020. The launch of these new gaming consoles will drive robust multi-year demand in graphics memory, and these consoles will deploy SSDs in place of hard drives for the first time. This continues a trend of SSDs replacing hard drives across more high-volume applications.

In the PC market, bit shipments in fiscal first quarter continued the growth trend from last quarter. Nevertheless, we are cautious on our near-term outlook for the PC segment due to reported CPU shortages, which seem likely to continue at least into early calendar 2020.

In automotive, despite sluggish worldwide auto sales, we saw quarter-over-quarter revenue growth driven by secular memory and storage content growth. Our leadership in low-power DRAM is also driving growth for us in this market. In fiscal first quarter, we qualified and shipped the industry’s first BGA NVMe SSD for automotive applications, which offers industry-leading performance and capacity in a small form factor and is well-suited to service the storage needs of increasing autonomous features.

Now turning to our market outlook. Our base-case assumption on which all our projections are based, assumes that there are no perturbations to the demand environment due to macroeconomic conditions or trade-related developments.

In DRAM, there has been a strong recovery in the second half of calendar 2019, and our view of calendar 2019 industry bit demand growth has increased to approximately 20%. This stronger than expected demand has resulted in pockets of shortages for us. We continue to exercise price discipline and walk away from price requests that do not meet our objectives. While these actions may impact short-term revenue, improving our business mix will enhance our long-term profitability. We are encouraged by recent DRAM pricing trends and are optimistic about improving supply demand balance throughout calendar 2020.

As we discussed on our last call, a portion of the strength in demand in the second half of calendar 2019 may be attributable to inventory builds in China, and we expect some of this customer inventory to normalize sometime in calendar 2020. As a result, we expect calendar 2020 industry DRAM bit demand growth to be in the mid-teens percent range year-over-year, which is somewhat lower than our prior outlook, due to stronger demand in calendar 2019.

We expect industry bit supply growth for calendar 2020 to be somewhat less than the demand as industry bit supply growth decelerates due to industry capex reductions. We continue to target our long-term bit supply growth CAGR to be close to the industry’s long-term bit demand growth CAGR of mid-to-high teens. In calendar 2019, our bit supply growth will be less than the industry supply growth of mid-teens, and in 2020 our bit supply growth is expected to be slightly above industry bit supply growth.

Turning to NAND, our industry bit demand growth expectation is in the mid-40% range in calendar 2019, and high 20s to low 30s percent range in calendar 2020. We expect calendar 2020 industry bit supply to be lower than industry bit demand as a result of industry capex reductions, and consequently, we expect the industry environment to improve through calendar 2020.

Micron’s NAND bit supply growth in calendar 2019 is likely to be slightly below industry bit demand growth and in calendar 2020 will be meaningfully below that of the industry. However, we expect our NAND bit shipment growth in calendar 2020 to be close to industry bit demand growth as we ship our inventory during the first generation of our RG transition. As we go through the transition to replacement gate, we expect our multi-year supply growth CAGR to be in line with the industry’s demand CAGR of approximately 30%.

Before I turn it over to Dave, I wanted to provide an update on our business with Huawei. As previously disclosed, we are continuing to ship some products to Huawei that are not subject to Export Administration Regulations and Entity List restrictions. We applied for, and recently received, all requested licenses that enable us to provide support for these products, as well as qualify new products for Huawei’s mobile and server businesses. Additionally, these licenses allow us to ship previously restricted products that we manufacture in the United States, which represent a very small portion of our sales. However, there are still some products outside of the mobile and server markets that we are unable to sell to Huawei.

Receiving the licenses is a positive development, and we are thankful to the US administration for approving these licenses. Prior to receiving these licenses, Entity List restrictions severely limited our ability to qualify new products at Huawei. Although, we are now able to qualify new products with Huawei’s mobile and server businesses, it will take some time before the qualifications are completed and contribute to revenue. Consequently, we do not expect these licenses to have a material impact on our revenue in the next couple of quarters.

I’ll now turn it over to Dave to provide our financial results and guidance.

David Zinsner — Senior Vice President and Chief Financial Officer

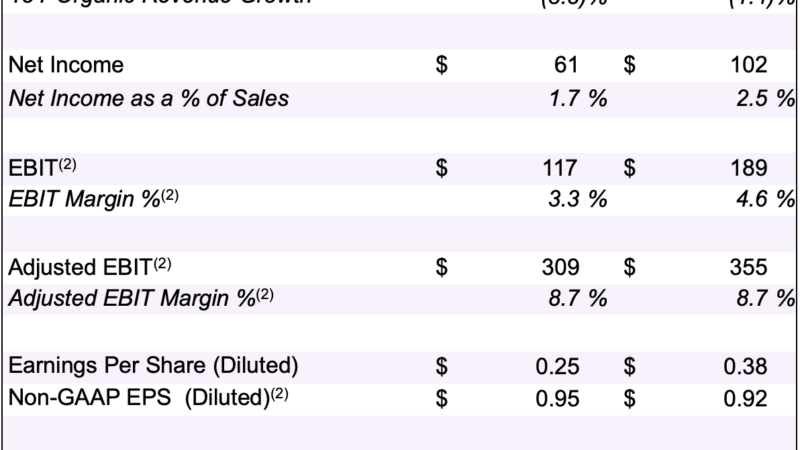

Thanks. Sanjay. Micron’s FQ1 results were largely consistent with our expectations as market conditions continued to stabilize. During the quarter, DRAM price declines decelerated from recent quarters, and we saw pricing improvements in NAND. Total company revenues grew sequentially, and our total inventory declined in absolute terms. We generated positive free cash flow during the quarter, made progress on our share repurchase program, and further strengthened our balance sheet.

The results on today’s call reflect our previously announced changes in NAND depreciable life to seven years from five years, and the change in reporting from our previous disclosures, which classified all MCP and SSD revenues as NAND revenue, to a view now that disaggregates these revenues into DRAM and NAND.

The following DRAM and NAND growth figures use restated historical revenues for an apples-to-apples comparison. Total FQ1 revenue was approximately $5.1 billion. Revenue was up 6% sequentially and down 35% year-over-year. FQ1 DRAM revenue was $3.5 billion, representing 67% of total revenue. DRAM revenue increased 2% sequentially and declined 41% year-on-year. Bit shipments grew approximately 10% sequentially and on a year-on-year basis were up in the mid-20% range. ASP declined in the upper-single-digit percent range sequentially. DRAM revenues included $435 million of revenues from MCPs and SSDs.

FQ1 NAND revenue was approximately $1.4 billion, or 28% of total revenue. Revenue was up 18% sequentially and declined 14% year-on-year. Bit shipments grew in the mid-teen percent range sequentially and in the mid-30% range year-on-year. ASPs increased in the low-single digits sequentially.

Now turning to our revenue trends by business unit. Revenue for the Compute and Networking Business Unit was approximately $2 billion, an increase of 4%

sequentially and down 45% year-over-year. The sequential increase was driven by higher volumes and moderating ASP declines.

Revenue for the Mobile Business Unit was $1.5 billion, up 4% sequentially and down 34% year-over-year. MCP revenues grew strongly during the quarter driven by approximately 50% sequential growth in DRAM and NAND bits. Revenue for the Storage Business Unit in FQ1 was $968 million, an increase of 14% from FQ4 and down 15% year-over-year. Sequential revenue growth was driven by SSD volume growth and ASP increases.

Finally, revenue for the Embedded Business Unit was $734 million, up 4% from FQ4 and down 21% from the prior year. Sequential revenue growth was mostly driven by the automotive market due to content growth.

The consolidated gross margin for FQ1 was 27.3%, slightly above the midpoint of our guidance. FQ1 gross margins included approximately a 240-basis point negative impact or approximately $125 million due to underutilization charges at the Lehi Fab. This came in slightly better than we guided to on last quarter’s call, but underutilization charges are expected to ramp higher in FQ2 as production volumes decline. We still expect the underutilization charges to average $150 million per quarter in the first half of fiscal 2020. We have taken action to reduce our spending in the Lehi Fab, which should begin to reduce underutilization charges in fiscal 2021 as these actions are implemented. Ultimately, these charges will be mitigated as our own 3D XPoint products ramp into production over the coming years.

Operating expenses were $811 million as we incurred higher than usual R&D expenses to qualify new products. We expect to operate at higher levels of qualification expenses for the remainder of fiscal 2020 as we continue to expand our product portfolio. As a result, we now expect operating expenses to be approximately $3.3 billion for the fiscal year. We continue to prudently control all other operating expenses and remain flexible, should business conditions warrant.

FQ1 operating income was $594 million, representing 12% of revenue. Operating margin was down 38 percentage points year-over-year and down 3 percentage points from FQ4. Our FQ1 effective tax rate was 6.9%. We expect our tax rate to be approximately 5% for the remainder of the fiscal year. Non-GAAP earnings per share in FQ1 were $0.48 down from $0.56 in FQ4 and $2.97 in the year-ago quarter.

Turning to cash flows and capital spending, we generated $2 billion in cash from operations in FQ1, representing 40% of revenue. During the quarter, net capital spending was approximately $1.9 billion, down from approximately $2 billion in the prior quarter. We are continuing to target FY ’20 capex in the range of $7 billion to $8 billion.

We generated adjusted free cash flow of approximately $80 million in FQ1 compared to $260 million last quarter, and approximately $2.3 billion in the year-ago quarter.

In FQ1, we repurchased 1.1 million shares for $50 million. In addition, we deployed approximately $200 million of cash to settle convertible note redemptions in the quarter removing approximately 3 million shares from our fully diluted share count. We will continue to target deploying at least 50% of our annual free cash flow toward repurchases.

Days of inventory was 121, down from 131 days in FQ4. Inventory ended the quarter at $4.9 billion, down slightly from $5.1 billion at the end of FQ4. Over the last two quarters, our inventory days have declined by approximately 15%. We expect inventory days to increase in fiscal Q2 due to seasonality and then begin to reduce again for the remainder of the year.

We ended the quarter with total cash of $8.3 billion and total liquidity of nearly $11 billion. We deployed approximately $1.3 billion of liquidity in FQ1 to fund the closing of our acquisition of Intel’s stake in the IMFT joint venture. FQ1 ending total debt was $5.7 billion, down slightly from the prior quarter. In addition to the retirement of IMFT’s member debt, we used cash on hand to retire approximately $520 million in principal of high-yield debt. This was partially offset by the draw-down of our term loan facility to fund the IMFT acquisition.

Our balance sheet is very strong with net cash of $2.7 billion, and we remain committed to maintaining a net cash position. Last month, S&P upgraded Micron’s credit rating to investment grade, and now all three rating agencies rate Micron’s credit as investment grade.

Now turning to our financial outlook. As Sanjay mentioned, our outlook throughout our earnings commentary assumes that the macroeconomic environment and trade-related issues will not impact demand. Micron’s fiscal second quarter is the seasonally weakest quarter for the industry. We continue to exercise pricing discipline and reduce business at customers where pricing does not meet our objectives, and this limits our business opportunity within the quarter.

Additionally, in FQ2 pockets of supply tightness are limiting our bit shipments, Lehi underutilization costs are going to step up, and our cost reductions are likely to remain modest. However, we are encouraged by recent market trends and expect that FQ2 will be the bottom of our gross margins, as pricing, increasing mix of high-value solutions, and cost reductions drive better gross margins throughout the rest of fiscal and calendar 2020. We expect a gradual recovery to start in FQ3, and to continue into the seasonally stronger second half of calendar year.

With that in mind, our non-GAAP guidance for fiscal Q2 is as follows. We expect revenue to be in the range of $4.5 billion to $4.8 billion, gross margin to be in the range of 27% plus or minus 150 basis points, and operating expenses to be approximately $825 million, plus or minus $25 million. Interest and other income is expected to be approximately zero. Based on a share count of approximately 1.14 billion fully diluted shares, we expect EPS to be $0.35, plus or minus $0.06.

As we approach the trough in this cycle, at the midpoint of our guidance, fiscal Q2 revenue will be 60% higher and gross margins 9 percentage points higher than in the prior trough, which occurred in the fiscal third quarter of 2016. Micron’s solid financial performance and investment-grade balance sheet demonstrate that the New Micron is indeed structurally stronger, with higher lows and better cross-cycle revenue growth and profitability.

I’ll now turn the call over to Sanjay for closing remarks.

Sanjay Mehrotra — President and Chief Executive Officer

Thank you, Dave. Micron is entering 2020 as a fundamentally stronger company, in an industry that is structurally transformed. Supply growth is moderating due to rising capital intensity and the slowing of Moore’s Law. Demand drivers are more diversified than ever before, both in end markets and in the variety of memory and storage solutions. This change in industry dynamics creates new opportunities for Micron to innovate and provide differentiated value to customers.

Nascent applications promise to further accelerate this diversification. Cloud growth continues at a brisk pace, driven by new use cases, and 5G networks are just beginning to proliferate and will usher in an age of true machine-to-machine communication with billions of connected devices. And just a little further over the horizon, AI, machine learning, and autonomous technologies will expand this potential even more. These trends are transforming every aspect of human life and driving secular growth in memory and storage.

Micron’s enhanced product portfolio, improved cost structure, and talented team put us in an outstanding position to capitalize on the wealth of opportunities ahead and create long-term shareholder value.

We will now open for questions.

Questions and Answers:

Operator

Thank you. [Operator Instructions] Our first question comes from the line of Srini Pajjuri of SMBC Nikko. Your line is open.

Srini Pajjuri — SMBC Nikko — Analyst

Thank you. Sanjay, just a couple of questions. I guess first on the supply shortages that you talked about, could you please elaborate because on one hand, you were talking about some shortages, on the other hand, the inventories are going up as we head into the next quarter. I’m going to have a follow-up.

Sanjay Mehrotra — President and Chief Executive Officer

So as we said last time as well as in this earnings call that we have certain shortages in DRAM on the leading-edge nodes. And you we have brought down our inventory here, overall inventory down fairly fast as Dave pointed out. And we have seen strong growth in demand in DRAM on high-quality, high-density modules for servers, as well as demand trends have continued to be pretty solid.

So shortages on the leading-edge nodes on DRAM and on the NAND side, we have SSD demand growing up substantially. And our 96-layer products, as we expand the portfolio are being qualified by customers. We are seeing strong demand on our 64-layer node, where we are actually seeing some shortages and of course, as we mentioned, we experienced some back-end constraints as well. We have invested in back-end capacity, assembly and test capacity expansion. And that’s — we’ll — assembly and test issues impacting some of our multi-die stack on the Mobile solutions as well as SSD solutions. The assembly and test constraints will be eliminated, largely by the end of fiscal second quarter.

So these are some of the things that are impacting, some of the shortages, both in DRAM and on the NAND side. And again the demand trends continue to be solid. Of course in CQ1, we see seasonality. And yes, some of our inventory may go up at the end of fiscal Q2. But overall our normal inventory days is around, — as we look ahead is around 110 days, and you know that’s really a function of increasing complexity coming from the technology nodes, as well as, as we shift toward high value solutions, more SSDs, more multi-chip packages, they take longer assembly and test times as well. So those are the ones that are contributing to some of the aspects of days of inventory that when we foresee in the future, we look at it as approximately 110 days.

So industry environment in terms of demand continues to be solid, pockets of shortage is building all across the industry, certainly we are experiencing that. And pricing trends overall in the industry, as you look ahead at 2020, we are optimistic about the improving pricing trends in the industry as well.

Operator

Thank you. [Operator Instructions] Our next question comes from the line of John Pitzer of Credit Suisse. Your line is open.

John Pitzer — Credit Suisse — Analyst

How are you guys? Congratulations on the solid results. So, Sanjay, I wanted to talk a little bit about the capex guidance for this fiscal year. I think I understand the strategy around NAND to kind of constrained spending on the first generation of replacement gate, where cost downs are de minimis and kind of weight to Version 2.0. But I’m kind of curious as you think about the DRAM strategy, especially given that demand came in much stronger than expected, this year, 20%, and there were some of us that thought at the beginning the year, we’d be lucky to get to low double-digit growth. How do we think about DRAM capex from here and your ability to kind of keep up with industry bit growth? And I guess specifically my question is, how much, leeway do you have in moving more of your mix of DRAM toward the leading-edge node as a way to grow bits rather than just shrinking?

Sanjay Mehrotra — President and Chief Executive Officer

Certainly as we move our DRAM production to leading-edge nodes, for example, through 1Z, where we mentioned that we did very well with ramping 1Z DRAM node in our mobile products during the quarter. So of course those give us a bit growth. It comes with the shrink capability and technology transitions are the best way to achieve ROI as well.

What’s important is, that we are being extremely disciplined and prudent in terms of managing our supply of bit growth and we want to make sure that it’s aligned with our bit demand growth as well as our long-term objective is to have our supply bit growth CAGR to be aligned with the industry demand growth CAGR. We mentioned that in 2019, our DRAM supply growth somewhat below the industry supply growth and in fiscal year 2020, we — in calendar year 2020, we see our supply growth to be somewhat above the industry supply growth. But all in all, our strategy is to have our supply growth CAGR to be aligned with the industry demand growth CAGR.

We feel very good about, — when we look ahead at 2020, our supply, overall position, and yes, I mean we are experiencing certain shortages on leading-nodes, and we believe that some of these shortages in the industry, as well as for us will continue in calendar year 2020 timeframe. And frankly that’s a good place to be at in terms of running the business, because it helps you manage the best mix of the business as well in terms of revenue and profitability.

Operator

Thank you. Our next question comes from CJ Muse of Evercore. Your line is open.

CJ Muse — Evercore. — Analyst

Yeah, hi, thanks for taking the question. I guess a question on the DRAM demand side. You’re outlining an outlook for 15 — sorry, mid-teens growth in 2020. I am curious as you think about that number, how much of that, I guess, relates to potential pulling of China demand, potential conservatism on your part? And within that, what kind of assumptions are you making around 5G handsets and continued cloud spending through 2020? Thank you.

Sanjay Mehrotra — President and Chief Executive Officer

So certainly 5G will be a growth driver. We expect 5G handset smartphones to be more weighted toward the second half of the calendar year. Cloud capex as you have seen the reports from various major cloud providers, cloud capex continues to be healthy, a meaningful portion of the cloud capex goes into memory and storage, and that continues to drive above average industry — above average demand as a percentage, which is the average of the total DRAM industry.

And 5G phones, I think it’s important to note that you content continues to grow as we mentioned in our script. I mean of course, 4G phones content continues to grow, but 5G phones are driving a step-level function increase in the average content of both DRAM as well as NAND. And our estimation is that in calendar year 2020, approximately 200 million of 5G smartphones to be sold on a global basis.

So overall, when we look at the demand — industry demand of mid-teens that we have projected for calendar year 2020, keep in mind that is building upon calendar year 2019, where industry demand in the second half came in quite strong and in fact we upped our estimate of industry demand growth to approximately 20% for 2019. So you are working off a large demand, larger than previously expected total bit shipments in 2019, and obviously that has an impact on the percentage that we look at for 2020. But in terms of aggregate of bit demand, that continues to be pretty solid in 2020 as well. And as we said, 2019 was a headwind in terms of demand and supply for the industry and 2020, we look at demand and supply balance as a tailwind for the industry.

Operator

Thank you. Our next question comes from Aaron Rakers of Wells Fargo Securities. Your line is open.

Aaron Rakers — Wells Fargo Securities. — Analyst

Yeah, thanks for taking the question. I guess just on the capital expenditure front, obviously you guys have talked about, reiterated to capex, but you’re also — on the Taiwan fab, you’re noting that fab is capable of EUV. I know you’ve talked about that you don’t need that through the 1 gamma node, but it kind of suggests that you are looking at EUV as potentially something that you’re evaluating. Have you pulled it, all your thoughts on EUV? And how do we think about that in the context of capex, not necessarily this year but looking out into the subsequent years? Thank you.

Sanjay Mehrotra — President and Chief Executive Officer

So at this point we’re not providing guidance for any time frame beyond our fiscal year 2020 in terms of capex. But as we have always said, we have been evaluating EUV technology. We have carefully evaluated EUV technology in terms of determining our roadmap for DRAM. And as you noted, through — we have said that through 1 gamma node, today we are in production with now 1Z node, starting production with 1Z and of course volume production also of 1Y node. So from 1Y to 1Z, as we look ahead at the next few generations through 1 alpha, 1 beta and 1 gamma generations, we see that of multi-patterning techniques along with immersion technology will serve us well in terms of achieving our cost objectives and having a highly cost competitive roadmap for us.

So we have also said that we continue to evaluate EUV, and then we see it appropriate for deployment in our DRAM production. In terms of cost and efficiency of production, we will certainly be deploying it at a future time in that, but at this point, we see our technology roadmap through 1 gamma node to be in strong position, while we remain encouraged seeing the improvement in EUV productivity tool as well.

But regarding capex for future years, we’ll obviously always manage it as a function of our supply growth expectations as well as a function of technology and cost competitiveness and keeping our supply growth, as I said previously, aligned with demand CAGR, that’s how we will manage it. And we’ll share those details with you at appropriate time in the future.

Operator

Thank you. Our next question comes from Mark Delaney of Goldman Sachs. Your line is open.

Mark Delaney — Goldman Sachs. — Analyst

Yeah, good afternoon. Thanks for taking the question. So to better understand the company’s commentary on its own inventory, which — nice to see that come down in dollars and days in the just completed quarter. You — as you think about your inventory, as you move through the year, I understood some of the aggregate commentary, but can you, a bit more specific, because I think, the company has been carrying extra inventory of some of these older DRAM nodes, when do you think that gets used up?

And when you talk about 110 days, Sanjay, is that being a more normal level of inventory? Just given because the company is going to be carrying the extra NAND inventory for the replacement gate node. Should we be thinking about inventory running above 110 throughout [Phonetic] this year, or is the 110, really a this year comment as you carry some of that extra replacement gate inventory, and is longer term it’s something lower than that? Thanks.

David Zinsner — Senior Vice President and Chief Financial Officer

Yeah, that’s a good question. So, I’ll try and take a crack at that first. So yeah, the comment around 110 days is kind of an optimal level of inventory when we have worked off all of the excess inventory associated with the replacement gate transition and as inventories normalize. Obviously, in the 121 days of inventory that we have today, DRAM is a bit below that, really what pulls it up to a 121 is that, NAND is quite a bit higher than that by virtue of the fact that we are executing on this strategy to hold a lot of inventory as we go into our replacement gate transition to augment what will be a robust bit growth from that first node.

As Sanjay mentioned, we do expect days of inventory to go up a bit based on mix and so forth in the second quarter, because of seasonality. But we would expect it then to start trending down over the next few quarters, partly as we start to utilize this success — of NAND inventory for the replacement gate transition and also as we start to digest and administer this — the mix challenges that have created a little bit of excess spill on the DRAM front. So, we should be in pretty healthy place on DRAM within a couple of quarters.

Operator

Thank you. Our next question comes from Ambrish Srivastava of BMO Capital Markets. Your line is open.

Ambrish Srivastava — BMO Capital Markets. — Analyst

Hi. Good to see you pilot through [Phonetic] this downturn with positive free cash flow. I just wanted to get back to the comment that Sanjay, you’re making about the fiscal second quarter marking the bottom for fundamentals. And capex seems to be a little bit front-end loaded, so is free cash flow going to be positive in the fiscal second quarter as well?

David Zinsner — Senior Vice President and Chief Financial Officer

So I’ll take a crack at that one too. I would say, maybe to start with, that the first priority of the company is to make the appropriate level investments, both in terms of R&D and which is why we have had a little bit of an increase in operating expenses, because we do want to put the right level of investment in new products, particularly high value solution products that will ultimately be the big factor in terms of our performance over the coming years. And in addition, we obviously want to make the appropriate level in terms of capex investments to make sure that we are, as Sanjay mentioned, investing the right level to manage supply growth and to make these node transitions.

In — secondarily, of course, our goal is to generate good free cash flow and ideally it was — it would be to generate pretty consistent free cash flow over multiple — or over every quarter. I would say in the second quarter what we feel really confident about is that, cash flow from operations is going to be very strong. And we will again make appropriate level of capex investment that could drive the free cash flow to be slightly negative or roughly around zero or potentially even a little bit more positive, but we’re going to make the capital investment be what’s appropriate and let free cash flow go where it goes.

I would say, though, just to put this in perspective, the trough quarter of 2016, in terms of free cash flow was negative $1.3 billion, I believe. And so, if you compare that to whatever we end up doing for the second quarter, this will be massively better in terms of cash flow generation and of course that’s an indication of, or an example of how we have structurally improved the business from a cost competitive perspective and from a cash flow perspective.

And indeed, if this does turn out to be the bottom, as Sanjay indicated is our expectation barring any sort of macro event or trade event, we would expect free cash flow to track more positively through the remainder of the fiscal year and into the — and into the next fiscal year. So this year will be actually a pretty good year in terms of free cash flow. That’ll be four consecutive years of positive, significantly positive free cash flow for the company, which of course has never been done in Micron’s history. So again, ideally, we’d like to have, every quarter to be positive, that may or may not happen this quarter, but clearly, we’re on the right track in terms of generating positive free cash flow for the company.

Operator

Thank you. Our next question comes from Harlan Sur of JPMorgan. Your line is open.

Harlan Sur — JPMorgan. — Analyst

Good afternoon and thanks for taking my question. We’ve seen a strong reacceleration in cloud and hyperscale spending, also seeing some near-term strong server builds by the Asia OEMs. And it appears that the excess DRAM channel inventories in this segment have been worked on, but wanted to get your views here. And typically the cloud spending up cycle duration is about three to four quarters. So, even in a seasonally weaker period for PCs and smartphones in the first part of next year, do you see the server and data center demand remaining fairly strong?

Sanjay Mehrotra — President and Chief Executive Officer

Yes. As we look ahead, we do see server and data center demand particularly within cloud to be strong. We have had, as we mentioned in our FQ1, strong growth from cloud and we certainly see that happening through 2020 as well as. As we mentioned, high-densities [Phonetic] are actually in shortage in the industry. And it really is about all the trend of more AI workloads, more need for memory and storage as CPUs get introduced that can work with higher density memory as well as have more channels, which is increasing the attach rate of DRAM content for server and increasing it. So these are all the trend that actually point to continuing higher than industry average level of growth for DRAMs in the cloud and server.

And same thing on the NAND, on the SSD front, average density as well as the average usage of flash in clouds and data center applications continues to increase. And we have always said, that this is the long-term demand driver for memory and storage industry. And memory and storage is critical in terms of driving greater value in these cloud applications and in these enterprise applications, and hence you are seeing continuing strong growth in these end-market segments.

And I’d just like to point out, that even in 2019, while the demand to the suppliers was weaker in the first half of the year, because the customers, particularly in this space were using up the inventory that they had to meet end consumption, but it’s important to understand that the end consumption of DRAM and NAND even in challenging 2019 periods continued to be healthy. And as we look ahead, this will be a strong driver of growth in the industry, but I just want to point out that, as we previously discussed, smartphones, content growth there, automotive applications, continuing to drive greater content, graphics, gaming consoles, new gaming consoles are also driving HDD replacement with SSDs as well as greater DRAM content in those applications. So, I think the demand drivers and our pieces that has always been there, that the industry has strong demand drivers has very much been intact. And we look forward to good environment for our industry in 2020.

Operator

Thank you. Our next question comes from David Wong of Instinet. Your line is open.

David Wong — Instinet — Analyst

Thanks very much. Could you tell us what proportion of DRAM bits are currently on 1Z technology? And what do you expect will be on 1Z technology by the end of calendar 2020? And what’s the differences between cost per bit on 1Z compared to 1Y?

Sanjay Mehrotra — President and Chief Executive Officer

So we don’t provide cost details with respect to 1Z versus 1Y or from one node to the other node. But as we have said before, that we expect our 1Y plus 1Z combined bit production to cross over our total bit production by summer of 2020. That means, bit crossover with 1Y and 1Z combined by summer of 2020. And as we mentioned, we are doing well with [Phonetic] 1Z, and in fact in mobile products, as I mentioned in my prepared remarks, we saw the fastest ramp of 1Z node in the history of our mobile presence.

David Wong — Instinet — Analyst

Great, thanks.

Operator

Thank you. Our next question comes from Joe Moore of Morgan Stanley. Your question, please.

Joe Moore — Morgan Stanley — Analyst

Great, thank you. I wanted to ask a bit more about the China inventory build that you talked about. Can you kind of talk about the reasons, is it concern about ability to procure? Is it tariff related? What’s the reason for the pull-in? And anyway you can help us kind of understand the magnitude would be helpful. Thank you.

Sanjay Mehrotra — President and Chief Executive Officer

As we have mentioned before, we saw some China buying pattern that was above normal compared to the past that we have seen. And we attribute that to some of the US/China trade tensions, and perhaps some of the customers in China procuring and shifting to, perhaps a longer-term strategy of carrying more inventory, because in terms of the US/China trade aspects, while Phase 1 deal is definitely encouraging to see, that is happening. But there is still ongoing for longer-term lack of clarity. So perhaps, some of the China customers have shifted their strategy toward carrying higher levels of inventory. I would say that, that perhaps is an important reason. There is of course Chinese New Year as well, that can play a role in the China demand, Chinese New Year is earlier this year compared to the typical years, but there is no question that, most important thing is that the underlying demand drivers are strong. And when you look at smartphone content growth, that’s happening in all smartphones across the globe, including the ones sold by the China manufacturers, the contents both on DRAM and NAND side continues to increase, and certainly as we have talked about, 5G is — a significant driver and certainly 5G phones are planned to be sold, perhaps in largest quantities in China first. So all of these underlying demand trends, I think are the most important thing here as well.

Operator

Thank you. Our next question comes from Blayne Curtis of Barclays. Your question, please.

Blayne Curtis — Barclays — Analyst

Hey guys, thanks for taking my question. Maybe Sanjay, just a follow on Joe’s question, I’m just kind of curious, you said it’ll take couple of quarters for Huawei to get back to the numbers. Are you embedding anything in the calendar ’20 outlook you have? And I’m just kind of curious, following on that point, in terms of you’re expecting some moderation from China, have you seen any signs of that yet?

Sanjay Mehrotra — President and Chief Executive Officer

I’m sorry, I didn’t quite get the last part of the question, expecting…

Blayne Curtis — Barclays — Analyst

Following on Joe’s question, you’re expecting some moderation after an inventory build, have you seen it yet? Or is that just something you expect will happen at some point?

Sanjay Mehrotra — President and Chief Executive Officer

What we said is that in terms of our estimation of the industry demand growth in calendar year 2020, we have baked in that some of the inventory that we may have seen in China customers build, we have baked in that some of that will be consumed and inventory inventory levels will be lower than what we may be thinking at this point with those customers over the course of calendar year 2020.

And with respect to your first piece of the question on Huawei, we mentioned that, now that we have received the licenses, we are able to work with them on new product qualifications. And as you know well, new product qualifications do take you know a few months, couple of quarters before they get qualified into new platforms and then we can potentially look at additional opportunities, but at this point, I mean, our focus is to resume that product qualification work both for server, as well as mobile applications.

Operator

Thank you. Our next question comes from Raji Gill of Needham & Company. Please go ahead.

Raji Gill — Needham & Company. — Analyst

Yes, thanks and congrats as well as as you added to this cycle. A question on mix shift for NAND, specifically, Sanjay, you had mentioned that next year, you will be ramping at a higher rate NVMe SSDs, as well as UFS controllers in the China handset market. Could you talk a little bit about the trajectory of those products and how that positive mix shift in NAND will potentially affect overall margins? Thank you.

Sanjay Mehrotra — President and Chief Executive Officer

I’ll have Dave comment on the margin piece of it. But you know, certainly as we expand our portfolio of NVMe solutions for from clients to data center and of course certainly on the consumer side as well, we have done well as we reported for FQ1 in terms of expanding the portfolio and capitalizing on increased sales of SSDs. And we certainly look at gaining share throughout calendar 2020 as we expand our portfolio there.

I think what’s important to note is that our share there is today under-represented. So as we shift toward these higher value solutions with expanded portfolio, I mean we are basically trying to bring our share in line with what it should be given our share of the total NAND bits. And this is the part of the strategy that we talked about in terms of shifting the mix of our high value solutions, which now are at about 50% in terms of bits toward higher number in the future. And of course, part of that, ongoing shift is toward multi-chip packages as well as discrete managed NAND solutions for mobile applications, there we pointed out that on a year-over-year basis, we have increased our share by 50%. Yet we remain underrepresented and therein lies further opportunity for us to be increasing our share in these markets.

So, high value solutions is a very important part of our strategy. It enables us to gain greater stability, greater margin opportunity through the cycles, as well as brings us closer to understanding the application landscape with the customer. And I’m very pleased that Micron is executing quite well with respect to achieving our objective in this area.

David Zinsner — Senior Vice President and Chief Financial Officer

So obviously, high value solutions, the reason one — one of the major reasons for shifting the strategy to high value solutions is because they carry higher margins. I’ll just give you a data point, if you look back at fiscal ’19 and look at these high value solutions relative to consumer components, you’ll find the margins were about 30 points — 30 percentage points higher. So significantly higher — opportunity to get higher margins and, of course, that obviously helps the overall margins of the company.

Operator

Thank you. Last question comes from the line of Hans Mosesmann of Rosenblatt Securities. Your line is open.

Hans Mosesmann — Rosenblatt Securities — Analyst

Thank you. Congratulations to the team for the execution. Sanjay, on the the server and data center module dynamic where you’re seeing a higher mix of quality or higher density, what was the density on average a year ago, just to get a reference and how that has improved? And what exactly is driving this move? Is it a new processor architecture? Or is it market share gains? That would be helpful. Thanks.

Sanjay Mehrotra — President and Chief Executive Officer

Yeah, in cloud servers as well as enterprise server, the average density is around 3 giga — 300 gigabyte per server average consumption of DRAM. And this trend is expected when you look at the CAGR over the next few years, expected to continue to grow in double digit range anywhere when you look at ’19 to ’22 kind of CAGR, around 20% CAGR for average content growth in servers, in cloud and enterprise applications. So this is definitely a high growth area for the market.

And when you look at the new CPUs, like Cascade Lake and other new CPUs starting in 2019, as I mentioned earlier they support the usage of higher density chips, that means the support usage of 16 gigabyte chips, as well as more channels in the new CPUs and that is definitely driving greater ability to use more content per server for DRAM. And of course, at the end of the day, it’s about the working force [Phonetic] that applications are running, and those workloads are requiring — increasing requirement for speed and that’s translating into increasing requirement for memory as more and more real-time data analytics kind of applications and AI applications are being — applications are being done in enterprise and data center and cloud applications.

Hans Mosesmann — Rosenblatt Securities — Analyst

Great. And as a quick follow-up. Can you give us a commentary regarding 3D XPoint used in main memory, if there is a roadmap for that this year — this coming year?

Sanjay Mehrotra — President and Chief Executive Officer

So 3D XPoint, certainly as we said, exciting opportunity for us longer term. It definitely gives us differentiated opportunity with — as the only company in the world having NAND, DRAM and 3D XPoint. We have just introduced our first storage product with 3D XPoint, the world’s fastest SSD. And as you noted, I mean 3D XPoint certainly has opportunities on the memory side of the business as well. And as we look at engaging with the ecosystem, as we look at developing our products, these are the kind of opportunities both on the memory semantic applications as well as storage side of the applications, we’ll be addressing over the course of next few years as we expand our product portfolio in this area.

But certainly, 3D XPoint, — again these kind of things, breakthrough technologies take multiple years and require lot of ecosystem work to get the full use of the technology. And we are well on our way as we discussed at Micron Insight, and let me put a plug here again, that if you have not watched it, please do watch Sumit’s presentation, I think it gives you a pretty good perspective on the capabilities of 3D XPoint technology and our vision of the future with it.

Operator

[Operator Closing Remarks]

Duration: 65 minutes

Call participants:

Farhan Ahmad — Senior Director, Investor Relations

Sanjay Mehrotra — President and Chief Executive Officer

David Zinsner — Senior Vice President and Chief Financial Officer

Srini Pajjuri — SMBC Nikko — Analyst

John Pitzer — Credit Suisse — Analyst

CJ Muse — Evercore. — Analyst

Aaron Rakers — Wells Fargo Securities. — Analyst

Mark Delaney — Goldman Sachs. — Analyst

Ambrish Srivastava — BMO Capital Markets. — Analyst

Harlan Sur — JPMorgan. — Analyst

David Wong — Instinet — Analyst

Joe Moore — Morgan Stanley — Analyst

Blayne Curtis — Barclays — Analyst

Raji Gill — Needham & Company. — Analyst

Hans Mosesmann — Rosenblatt Securities — Analyst