Few can resist the allure of a sequel. Not even, it seems, in the investing world.

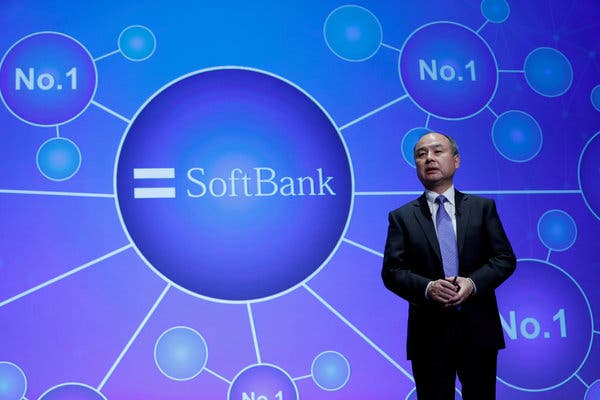

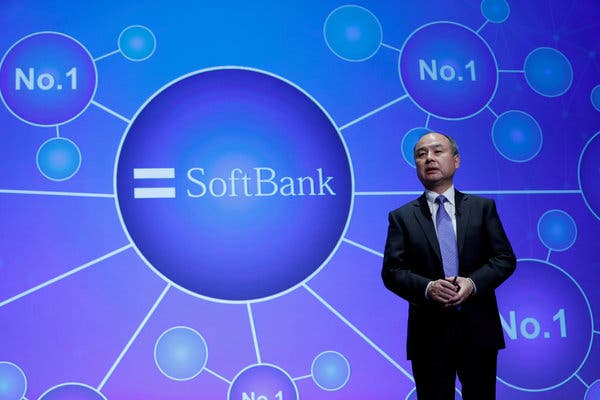

SoftBank announced on Friday that it was planning to create Vision Fund 2, a follow-up to the Japanese conglomerate’s $100 billion vehicle for investing in the technologies that it believes will shape the future.

Since it started in 2017, the first Vision Fund has placed bets on some the biggest rising names in tech, including Uber, WeWork, Slack and Bytedance, the Chinese owner of the video app TikTok.

SoftBank’s aggressive approach, which often involves offering start-ups outsize funding and demanding grandiose, ambitious ideas in return, has helped upend the venture capital market, and has even changed the way entrepreneurs build new tech companies.

The new fund has attracted about $108 billion in expected investment, SoftBank said, while adding that the size of the pot is likely to grow. The company is putting in $38 billion of its own money, and other expected investors include tech giants such as Apple, Microsoft and the Taiwanese manufacturer Foxconn; several major Japanese financial institutions; and the sovereign wealth fund of the oil-rich nation of Kazakhstan.

It is unclear, however, whether Vision Fund 2 will include contributions from one of its predecessor’s major backers: Saudi Arabia. The Middle Eastern kingdom provided $45 billion for the first Vision Fund, but the partnership became fraught after the killing last year of the Saudi dissident and journalist Jamal Khashoggi, which a United Nations report concluded had been authorized at the highest levels of the Saudi royal court.

SoftBank’s chief executive, Masayoshi Son, denounced Mr. Khashoggi’s murder, and canceled an appearance at an investment conference in Riyadh, the Saudi capital. But he said he would not cut ties with the Saudi government.

A statement from the company on Friday announcing the creation of Vision Fund 2 did not say whether Saudi Arabia would be an investor, and SoftBank said it had no additional comment on the matter.

The eclectic stable of firms that Mr. Son has assembled in the first Vision Fund — including ride-hailing companies, biotechnology firms, a mapmaker, a microchip designer, an educational app in China and even a dog-walking service — are united by a driving preoccupation of the Japanese billionaire’s: the coming transformation of life, work and everything by data and intelligent machines.

As of March, the fund had delivered a 29 percent overall return on investment, SoftBank said in May, and held 69 investments.

Even so, skeptics wondered whether Mr. Son would be able to wrangle enough investor interest in a second gigantic fund, with or without the Saudi government.

“Years ago, when Masa was pitching this concept, it was a concept,” said Chris Lane, an analyst at Sanford C. Bernstein, referring to Mr. Son by his nickname. “He raised the funds on the strength of his reputation and the strength of his vision, but to be honest, there was no proof that this could work.”

“What they have today is a track record,” Mr. Lane continued. It is only a two-year track record, he acknowledged. But with an established team of people running the fund and a clearer sense of how they evaluate potential investments, he said, “you’ve got a lot more confidence that it’s a robust process.”

That most likely helped Vision Fund 2 draw in large investment institutions, such as the Japanese banks, that might not traditionally pick up stakes in high-flying tech start-ups. The growing abundance of such private sources of capital has supercharged the tech industry and reshaped the financial landscape, a trend that arguably predated the Vision Fund.

“Companies are staying private longer, and are also raising more capital to stay the No. 1 players in their fields,” said Ron Cao, the founder of Sky9 Capital, a China-focused venture firm. “With the competitive environment for start-ups becoming more fierce, it’s more expensive to raise money to stay No. 1.”

“SoftBank saw an opportunity to raise a mega-fund to fill that gap,” Mr. Cao said. “I think the gap is still there.”