Technology stocks rise to their highest levels ever despite the trade war – CNBC

Michaela Rehle | Reuters

Big cap technology stocks hit an all-time high Tuesday, aided by a rebounding semiconductor sector amid some signs of progress in the trade war between the U.S. and China.

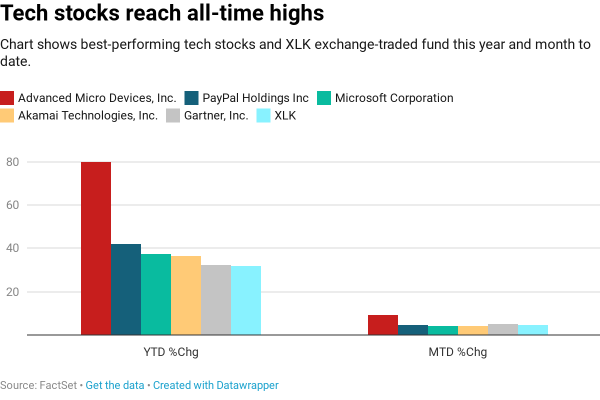

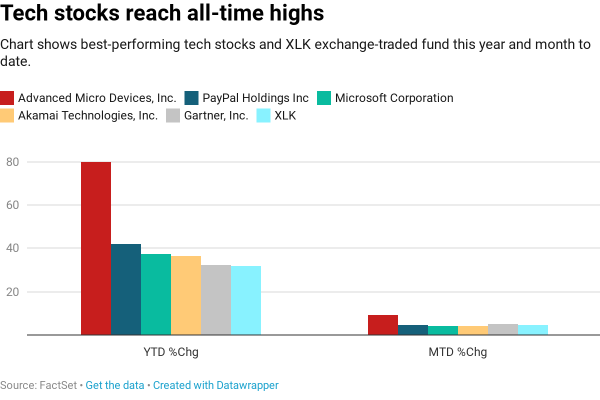

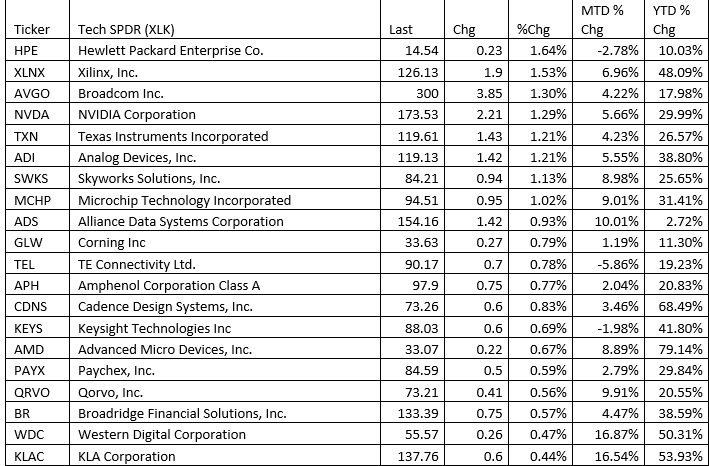

The Technology Select SPDR Fund ETF, XLK representing the technology sector within the S&P 500, briefly rose to a record $82.15 and was trading slightly higher in afternoon trading. The XLK is up 4.6% month-to-date and 31.7% so far this year.

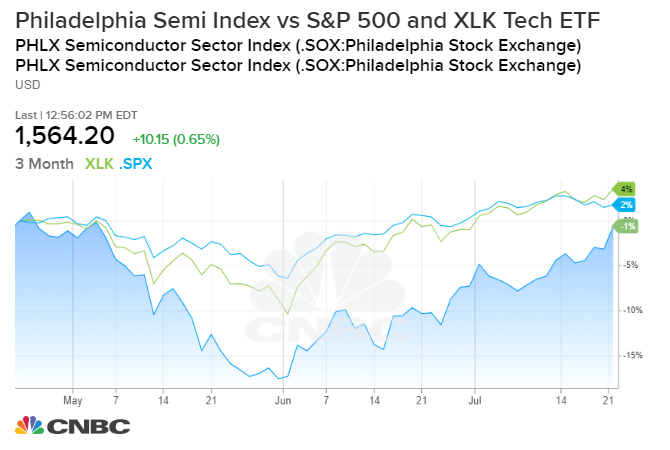

The sector has been boosted by a recent rebound in chip stocks, which have been mostly rising since the beginning of June. The Philadelphia Semiconductor Index is up 10.9% in the past month, and 7.2% for the month of July so far. It is up 35.2% year-to-date.

Chip stocks “remain the thin edge of the cyclical rotation edge,” Fundstrat technical analyst Robert Sluymer said in a note. “In contrast to defensive/safety groups, cyclicals, notably semis which we’ve focused on since early 2019, continue to show signs of emerging within longer-term cycles.”

Semiconductor companies are squarely in the cross hairs of the trade war between the U.S. and China, and had been hurt earlier in the year because of trade friction and also steep earnings declines. Chip suppliers to Huawei have been in limbo, after the U.S. blacklisted the Chinese telecom company.

Chips are ‘tip of the sword’ in trade war

“The semiconductors themselves have been the tip of the sword for trying to feel how things have been going in the trade war, and it feels like yesterday was a pivot in that it feels like [the U.S.] will give some on Huawei if [China] begins to buy some soy beans,” said Art Hogan, chief market strategist at National Securities. Hogan said the stocks have been a barometer for the trade wars, and have been doing better since the G-20 meeting between President Donald Trump and China President Xi Jinping in late June.

Trump agreed to requests by technology company officials visiting the White House Monday to help speed the process of licensing for certain product sales to Huawei. China has made moves to purchase U.S. agriculture products, in what is seen as a goodwill gesture.

Face-to-face talks between the U.S. and China are expected to resume next week in China, according to sources. Two sources told CNBC that the White House is now looking at a longer timeline for the talks that could now take six months.

“Basically, the tug of war, which is going on within the semiconductors… is the promise of the increased demand with the roll out of 5G, versus the drag from the escalation of trade tensions, especially in the month of May,” said Hogan. In May, trade negotiations hit a low and Trump put a new round of tariffs on China, knocking the wind out of the chip group and the broader market.

J.P. Morgan analysts Tuesday said they now see potential for a surprise move higher in the chip sector.

“Resumption of shipments to Huawei could be a source of upside though the situation remains fluid and we do not believe most suppliers are shipping products to Huawei at this time,” the analysts noted. But they pointed to the reports that said some U.S. suppliers may be able to obtain licenses to supply components to Huawai, where there is no national security threat.

There have been other positive signals for the sector. On Sunday, Goldman Sachs analyst Mark Delaney told clients he has become more positive on global memory stocks.

“We believe that Micron’s stock will trade more on memory pricing trends and intermediate term EPS expectations than FY20 earnings,” he wrote in a note. Goldman had been cautious on near-term fundamentals of memory chip companies because of excess inventory weighing on pricing in the near-term.

Delaney said he believes that memory inventory is now being depleted more quickly than he expected, and he still expects production to fall below longer term demand growth in 2020.

Also last week, Taiwan Semiconductor, seen as a bellwether, said it expects third quarter revenues to be 3% better than expected, and 5G should drive smartphone growth. Taiwan Semi is a major supplier to Apple, and its bullish comments were positive for chips in general but also Apple.

Cyclical rotation in stocks

Chris Verrone, technical analyst at Strategas, said he sees an interesting divergence within tech, as semis break out ahead of software.

“The presumption is within what has been the best sector – technology, there are both defensive an cyclical components, semis being the most cyclical and software being the most defensive,” he said. “If it’s happening in the best sector like technology, we’re suspecting it’s going to start happening in other places.”

It also could have implications for the broader market.

“I think it signals that we are in the midst of some type of leadership shift away from the low volatility, defensive corner of the market and into the more pro-cyclical corners,” he said. “We’re starting to see it in other areas — banks are outperforming utilities and high beta stocks outperforming those with lower beta.”

Verrone said the fact semiconductors have been moving, even with trade war fears, also makes a statement about the broader market. “Maybe it’s the markets way of saying that stuff doesn’t matter,” said Verrone.

Separately, J.P. Morgan’s technical analyst Jason Hunter said the semiconductor stocks are the first of the cyclically sensitive groups he follows to break through key pattern resistance.

“Since the group’s equity performance has had a decent correlation with global PMI data over the past two decades, the SOX Index has been a primary focus since the middle of 2018 when trade tensions increased and started to drive large divergences in global market performance,” he wrote. “The recent industry group outperformance versus the broad market potential restarts the bullish dynamic that dominated in the first quarter, but we need to see other cyclically sensitive markets follow along to build that confidence.”

Some of the best performing components of the XLK in the past month have been chip names, like Western Digital, up 15.6%; Applied Materials, up 11.8%; Micron, up 20.5% and Lam Research, up 10.2%. Qualcomm, however is lower by 1.2% in the period.

Top gainers in XLK Technology SPDR ETF July 23

CNBC’s Gina Francolla contributed to this story