Amkor Technology Inc (AMKR) Q3 2019 Earnings Call Transcript – Motley Fool

Image source: The Motley Fool.

Amkor Technology Inc (NASDAQ:AMKR)

Q3 2019 Earnings Call

Oct 28, 2019,

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Operator

Good day, ladies and gentlemen, and welcome to the Amkor Technology Third Quarter 2019 Earnings Conference Call. My name is Gigi, and I will be your conference facilitator today. [Operator Instructions] As a reminder, this conference is being recorded.

I would now like to turn the call over to Vincent Keenan, Vice President, Investor Relations. Mr. Keenan, please go ahead.

Vincent Keenan — Vice President, Investor Relations

Thank you, Gigi. Good afternoon, everyone, and thank you for joining us for Amkor’s third quarter 2019 earnings conference call. Joining me today are; Steve Kelley, our Chief Executive Officer; and Megan Faust, our Chief Financial Officer. Our earnings press release was filed with the SEC this afternoon and is available on our website.

During this conference call, we will use non-GAAP financial measures, and you can find the reconciliation to the US GAAP equivalent on our website. We will also make forward-looking statements about our expectations for Amkor’s future performance based on the environment as we currently see it. Of course actual results could be different. Please refer to our press release and other SEC filings for information on risk factors, uncertainties and exceptions that could cause actual results to differ materially from these expectations. Please note that the financial results discussed today are preliminary and final data will be included in our Form 10-Q.

And now, I would like to turn the call over to Steve.

Stephen D. Kelley — President and Chief Executive Officer

Good afternoon. Thanks for joining the call. Today, I’ll review our third quarter performance and fourth quarter outlook, then provide color on some of the markets and technologies, which are driving our second half revenue growth. I’ll also review Amkor’s strong position in the fastest growing parts of the semiconductor market.

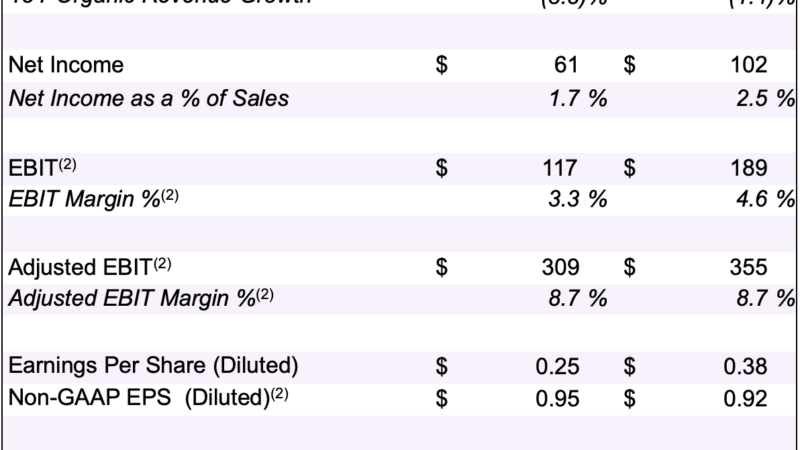

Third quarter revenue was above the high end of our guidance because of stronger-than-expected demand for advanced packages. Operating income, net income and EPS also exceeded guidance, largely due to our 21% sequential revenue growth and continued cost discipline. Successful launches of flagship phones with high Amkor content drove our sales in the communications market. In the consumer market, we benefited from the ramp of a new high volume advanced SiP product. Our revenue in the automotive and industrial market increased 10% sequentially with roughly equal gains in advanced and mainstream packages. ADAS and other digital intensive applications fuel demand for advanced packaging. Pipeline replenishment and new product launches drove growth in mainstream automotive packaging.

In the fourth quarter, we expect revenue and profitability similar to the third quarter. At the midpoint of our fourth quarter guidance, we expect second half 2019 revenue to be 22% higher than the first half. Amkor’s strong position in the communications, high volume consumer and automotive markets are driving that growth.

Despite our revenue gains in advanced packaging, we have not yet seen a similar recovery in the overall mainstream business. We expect our mainstream business to improve in 2020 as channel inventory issues are resolved. The return of mainstream demand to normal levels should provide a substantial upside opportunity for Amkor.

As we look to 2020 and beyond, we are pleased with our position in many of the fastest growing areas of the semiconductor market. In communications, the deployment of 5G technology will spur a new smartphone upgrade cycle, driving up unit demand. 5G technology will also be deployed in cars and factories and in other applications which require high speed wireless connectivity. Advanced package technology from Amkor has been chosen for many key 5G circuits and modules, including AP, baseband, RF, power management transceiver, sensor and antenna functions. We also see significant growth potential in the high volume consumer market. Amkor’s advanced SiP technology can be used to increase the functionality and improve the reliability of wearable and other small form factor products.

In automotive, we are benefiting from the widespread adoption of advanced packages for ADAS, infotainment and other digital intensive high pin count products. Amkor’s Flip Chip, Advanced SiP and wafer-level fan-out packages are all being used by automotive customers. Our automotive Flip Chip and SiP packages are built in high volume in our Korea factories, which for years have delivered outstanding quality and yield performance to a wide variety of demanding customers. Wafer-level fan-out products for automotive applications are built in our Portugal factory, which has a strong quality orientation well-suited for the automotive market.

In summary, our focus on delivering advanced technology, high quality and high yields has allowed us to establish a leadership position in many of the fastest growing semiconductor markets. These markets have been key to our revenue growth in the second half of 2019, and we expect them to drive revenue growth in future years.

Megan will now provide more detailed financial information.

Megan Faust — Corporate Vice President and Chief Financial Officer

Thank you, Steve, and good afternoon, everyone. Today, I will review our third quarter results and provide some comments about our fourth quarter outlook. We delivered a strong quarter of growth and profitability, driven by strength across multiple end markets.

Sequential revenue growth of 21% and cost discipline drove gross margin up 300 basis points to 17%. As a high fixed cost manufacturing business, when we have upward or downward changes in revenue, we typically see 40% to 50% of the revenue change drop through to gross profit. As a result of our cost reduction measures, only 30% of the third quarter year-over-year revenue decline dropped through to gross profit. The combination of strong revenue growth, manufacturing cost control and disciplined discretionary spending drove operating margin up nearly 500 basis points sequentially to 7%. EBITDA increased over 40% sequentially to $210 million or 19% of revenue.

The bank refinancing we did in July 2018 reduced annual interest expense by $11 million. Interest expense in the third quarter was $3 million lower than a year ago quarter. Earnings per share of $0.23 is nearly back to Q3 2018 levels. We closed out the quarter with a strong balance sheet, including $600 million of cash on hand, total liquidity of over $900 million and lower debt than a year ago quarter. We are well positioned to support future revenue growth, which will drive operating leverage as capacity utilization improves in our factories.

Moving on to our fourth quarter outlook, we expect revenue to be similar to the third quarter, around $1.1 billion. Fourth quarter gross margin is expected to be flat to the third quarter. Operating expenses are also expected to remain flat for the fourth quarter. Generally, our effective tax rate is around 25% subject to minimum level of taxes not dependent on our income.

We expect net income to be in the range of $26 million to $78 million and earnings per share of $0.11 to $0.32.We have a goal of generating positive free cash flow in 2019, a down year, which would represent our fifth consecutive year of positive free cash flow. We are holding our target for 2019 capex payments unchanged at $475 million. Capex is one of the key levers we use to control free cash flow and we will continue to stay disciplined and strategic on spending moving into 2020.

With that, we will now open the call up for your questions. Operator, you may begin the polling now.

Questions and Answers:

Operator

[Operator Instructions] Our first question is from Sidney Ho from Deutsche Bank. Your line is now open.

Sidney Ho — Deutsche Bank — Analyst

Thanks and congrats on the strong results and guide. Maybe first question I have is just looking at your 4Q guidance, understanding that both comps and consumer were quite a bit above seasonal growth in Q3. How should we think about the Q4 revenue growth by segment?

Stephen D. Kelley — President and Chief Executive Officer

So I’ll take that and then Megan can fill in any gaps that I leave in the answer. But Q4 is looking strong. We just are finishing up October and it’s going to be a very strong month for us. Normally, we would see a seasonal decline in November and December as the flagship phone cycle start to ebb and many customers focus on the year-end inventory control, that’s a typical Q4. It could be somewhat different this year, since inventory control has been the focus for many of our customers for most of 2019. So we may see a little bit more aggressiveness in November and December due to early Chinese New Year or late January this year. And also I think some customers are starting to come out of the inventory correction mode.

Sidney Ho — Deutsche Bank — Analyst

Okay, great. Maybe moving on along the same line on communications. Related to 5G, clearly there is an huge uptick in expectations from 5G handsets next year. And Steve you walk and — you talk about all the different composite — components you are doing for 5G. Your comps revenue in general is down about mid-teens this year, if 5G handsets come in as people expected 200 million to 250 million units. Do you think your comps revenue can get back to the previous highs? Maybe you can talk about some of the puts and takes there?

Stephen D. Kelley — President and Chief Executive Officer

Yeah, I think looking back on 2019, the first half is pretty difficult for comps, given the inventory corrections we are seeing in China and also in the iOS ecosystem. That’s obviously changed a lot in the second half with the launch of some pretty successful new phones. But I think the real upgrade catalyst is going to be next year with 5G. So I think — as I look into 2020, I see a combination of two things. I think you’re going to have some very good value 4G phones that will be selling well next year, in addition, you’ll have some very good performance 5G phones, and together, we’re going to drive some nice unit volumes in 2020. So I think the short answer to your question is, yes, I think the volumes get back to where they used to be next year and there is a bonus and that 5G offers additional content on top of what we currently deliver to 4G phones.

Sidney Ho — Deutsche Bank — Analyst

That’s great. Last question for me, in terms of capex, you guys have cut back on this year on the tough environment. How should we think about capex for next year maybe not a point estimate, if you’re not ready for that yet. But how should we think about — what is the normalized level from capex and what in next year will be above that because of some catch-up with capex this year?

Stephen D. Kelley — President and Chief Executive Officer

Yeah, let me make a few comments and Megan can give you some more specific numbers. But we did exercise capital discipline in 2019 and we’re going to bring that capital discipline into 2020. We still have a substantial part of our capacity which is underutilized. Now the general market remains in doldrums. And so I think when the general market comes back, that’s going to basically use capacity we already have in place. Our investments next year will be focused on high growth advanced packages in particular, and I’m going to think we’ll be investing more in system and package, advanced system and package capacity and other high growth advanced packages.

Megan Faust — Corporate Vice President and Chief Financial Officer

And so Sidney, just to give you a figure for modeling purposes, I think maintaining a similar 12% capital intensity would be appropriate.

Sidney Ho — Deutsche Bank — Analyst

Thank you.

Operator

Thank you. Our next question is from Randy Abrams from Credit Suisse. Your line is now open.

Randy Abrams — Credit Suisse — Analyst

Yes. Okay, thank you. Good result. Hey, I wanted to follow-up just on the general markets outlook. There’s been some mixed signals like TI had high profile, I guess, still guided that it’s still a soft environment. So I’m curious from those general markets, how you’re seeing it, because I know a few months ago, it sounded like you were starting to bottom and see pick up. I guess first from global customers and then also from the Japan business. And then the second end-market related question, just in the PC compute data center-related, I mean it looks like that it might still be a softer from the mix, but we’re seeing a bit of pickup in data center. So I’m curious how you see leverage to the — some of these new like high performance compute server where or kind of FPGA, just if you see any content gains or maybe less leverage to that channel?

Stephen D. Kelley — President and Chief Executive Officer

Hey, Randy, let me talk about the general market first. So the general market, I think, is a mixed bag right now. We’re seeing signs of life in automotive and that’s firstly a content story, of course, but it’s also a function of our strong position in that marketplace. We’ve got a big lead in automotive and very good position both in advanced and mainstream packages. I think in the rest of the general market, it’s very customer-specific as you’ve noted, I would say, most of the customers are still working through inventory issues, but we have some that are coming out of that. I think in total, as we look at our history with these types of inventory cyclical corrections, we expect that most of our customers should be out of the inventory correction mode by Q1 of next year.

Randy Abrams — Credit Suisse — Analyst

Okay, great. And then maybe to follow-up on the data center maybe what’s driving a bit of — where it’s a little bit more flattish and how you see that part of the market?

Stephen D. Kelley — President and Chief Executive Officer

Yeah. On the data center, I think, there’s various things to go into that. I would say, right now, we’re seeing some strength on the memory side but we’re seeing some weakness on some of the ASICs and FPGAs and so forth. And so a lot of it has to do with the timing of the shipments into the end application, and I think some of the things that are happening in China probably accelerated some of the shipments of those products into China last year and early this year, and now it creates a difficult comparison, right now.

Randy Abrams — Credit Suisse — Analyst

Okay. Yeah and that’s a good segue, just the question I wanted to ask because now it seems like the tariffs kind of moved to consumer, if they’re on-again, off-again for December. But to what extent are you seeing in things like smartphone, tablet PC, any pull-in demand in the fourth quarter and I guess at this stage it’s unpredictable what happens with the tariff. But given the builds in the third and fourth quarter, maybe an early look at how you see the — like what you think a normal seasonal first quarter is and if at this stage you think it looks normal to you?

Stephen D. Kelley — President and Chief Executive Officer

Yeah, it’s hard to gauge exactly how much of the demand in Q4 is for pull-in versus just better selling phones. But I think as we look at Q1 ’20. Obviously, we don’t provide any specific guidance. But the normal seasonality in Q1 is typically down around 8% sequentially. As I look at Q1 this year, I see some tailwinds and some potential headwinds. The tailwinds are at least couple of flagship phone launches in the March/April timeframe and that would require builds in Q1. I see potential recovery in the general market which will be gaining steam in Q1, and I think the consumer market will continue to be strong for us in Q1. So those are all tailwinds. I think the headwinds like you mentioned, if the potential December tariffs are causing pull-ins, then we could see some hangover in Q1. I think the early Chinese New Year could be a problem. And then I think lastly just general overall world economy and which way the economy is going here in early 2020.

Randy Abrams — Credit Suisse — Analyst

Okay. Now that’s helpful. And last question, it’s related to the China business. I just — in terms — there is a lot of tuck on the localization. You have the big Shanghai facility., but I’m curious the net impact, because it looks like China customers where you’ve had a bit less exposure are localizing to local sources and potentially I guess a local OSATs but then flipside is whether there is any pickup in international customers coming back are away from the China supply chain. So if you could kind of give a view how you see this — any shifts from localization between you’re pushing the Greater China and then also from the international customers?

Stephen D. Kelley — President and Chief Executive Officer

Sure. So from a localization standpoint, obviously, there is a big push today to localize wherever possible for Mainland Chinese customers. But for us, that’s nothing new, we’ve had that issue to deal with for as long as we’ve been operating in China. So our strategy is always to try to compete with the leading edge packaging. So our factory in Shanghai, which is the second biggest factory in Amkor, all it does is advanced packaging, and we compete very effectively with the local suppliers. So our job is to deliver a bundle of services and quality and yield to the customers in China that’s better than they can get locally. And that’s how we sustain the business there with local customers. In general, if the local OSATs can do everything that we could do, then we’re going to lose the business. So that’s why we have to stay one step ahead.

Randy Abrams — Credit Suisse — Analyst

Okay. And maybe give a perspective that Greater China business, how it is now and whether how you see the growth is trending from that Greater China percent of the business?

Stephen D. Kelley — President and Chief Executive Officer

Yeah, I think it’s flattened out. It’s been an area of focus for the company, but we’ve flattened out in Greater China. And so I think we’re seeing more growth from international customers at this point and that’s going to drive our business in 2020.

Randy Abrams — Credit Suisse — Analyst

Okay. Great. Thanks a lot, Steve and Megan.

Operator

Thank you. [Operator Instructions] At this time, I’m showing no further questions. I would like to turn the call back over to Vince for closing remarks.

Vincent Keenan — Vice President, Investor Relations

Thank you, Gigi. This ends the question-and-answer portion of our call. I will now turn the call back to Steve for his closing remarks.

Stephen D. Kelley — President and Chief Executive Officer

Yeah, I’d like to recap our key messages. First, third quarter revenue grew 21% sequentially, driving a significant improvement in profitability. Secondly, we expect fourth quarter revenue and profitability similar to the third quarter. And finally, we are pleased with our position in the fastest growing areas of the semiconductor market. Thank you very much for joining the call today.

Operator

[Operator Closing Remarks]

Duration: 22 minutes

Call participants:

Vincent Keenan — Vice President, Investor Relations

Stephen D. Kelley — President and Chief Executive Officer

Megan Faust — Corporate Vice President and Chief Financial Officer

Sidney Ho — Deutsche Bank — Analyst

Randy Abrams — Credit Suisse — Analyst